A German football club famed for its progressive politics and social activism has become the first to speak out publicly against a plan to raise as much as €2 billion ($2.2 billion) by selling broadcasting rights to a private equity group.

One week before a crucial vote by Germany’s top 36 clubs, Oke Göttlich, president of Bundesliga second-division side FC St Pauli, said the club could not back a deal without fundamental reform of the game’s business model.

“I think I need more detailed information on strategy, the business plan, regulations, distribution of money and governance,” he said in an interview.

“There’s been no discussion of a control of costs, whether it be through salary caps or squad numbers. No discussion of the effect of multiclub ownership or a discussion about those flooding the industry with money.”

European football has seen investment from petro-states to private equity billionaires create new powerhouses, currently led by likely Premier League champions Manchester City. In contrast, fan-led teams and strict ownership rules in Germany have managed to keep foreign investment largely at bay.

This has come at a price. German teams have won the coveted Champions League just three times since 2000, while Spain’s Real Madrid has six titles.

Buyout firms CVC Capital Partners, Blackstone Inc., EQT AB and Advent International are now bidding for a 12.5% share in the long-term domestic and international broadcasting rights of Germany’s top 36 professional football teams.

Read More: Firms Bid Around $2 Billion for German Football Rights

Raising €2 billion would value the media rights at around €16 billion in total. But officials at the governing body of German football told clubs in recent days that bids came in lower, people with knowledge of the matter said.

‘Cash-Addicted’ Clubs

At least 24 of Germany’s top 36 clubs need to approve any plan for it to go ahead. With the first of a series of crunch votes due on May 24, Göttlich called for a rethink.

“We at least need a little bit more time and discussion. They are putting a carrot in front of our faces. We all know how cash-addicted the clubs are.”

Hamburg-based St Pauli, whose fans have deep links with the city’s music and arts scenes, is not the only team skeptical of the plans. Other second-division teams are said to be uncertain, as well as top-flight outfits including FC Köln and FC Augsburg, according to people familiar with the bidding process.

FC Köln was unavailable for comment, while FC Augsburg did not respond to a request for comment.

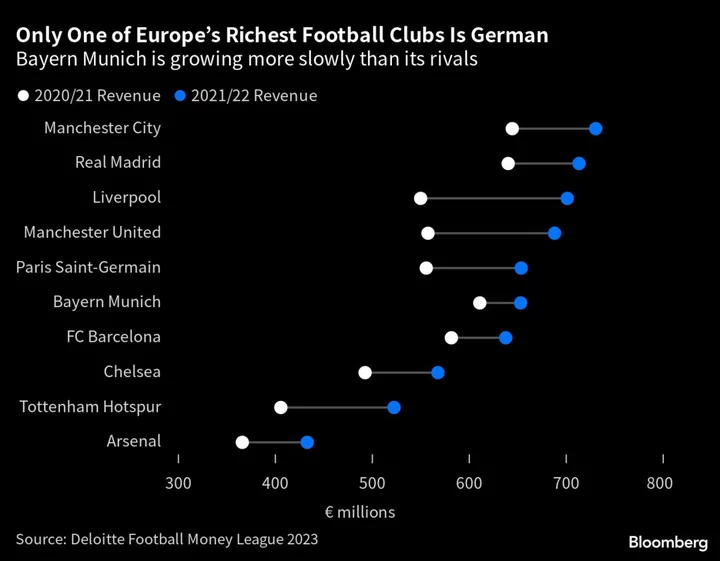

The St Pauli president — a former digital music executive and journalist — is concerned that the Bundesliga’s focus is mostly on strengthening the country’s leading clubs so that they are more competitive against rival clubs in Europe. Only the top two teams rank in Deloitte’s latest list of Europe’s top 20 richest clubs.

The plan would include an immediate payout with some funding directly for clubs. But Germany’s top league is already dominated by a handful of teams, with FC Bayern Munich crowned champions for 10 seasons in a row — though they are facing a challenge this year from Borussia Dortmund.

It’s a fear echoed by fans, with almost 70% opposed to outside investment, according to a recent survey by Kicker magazine. “It could be really dangerous for a lot of football teams — maybe not Bayern or Dortmund but for most other teams, because the gap between the funding the smaller teams and those big teams get would increase,” said Alexander Salzweger of Club Nr. 12, a Bayern fan group.

Home Focus

German football was described in a recent report by Enders Analysis as a “lagging market,” with overall broadcasting revenue down 7% for 2021-25 compared with the previous cycle.

England’s 20-team Premier League is expected to generate over €7 billion in revenue during the current season, compared to €3.6 billion from the 18 members in the Bundesliga’s top division, according to Stefan Ludwig, head of the sports business group at Deloitte.

Göttlich said that the league needs to find a way to ensure a higher percentage of domestic fans subscribe to pay television. “The main business for us is national TV. We’re not making tons of money from Hawaii for German football. Why should we? We need to evaluate what earns more money for us.”

“Is strengthening the first eight clubs the way we want to go, or is it the manifestation of non-solidarity?”

--With assistance from Eyk Henning.