China’s yuan is set to be boosted by year-end tailwinds and by speculation its recent rebound will encourage exporters to step up dollar sales, analysts say.

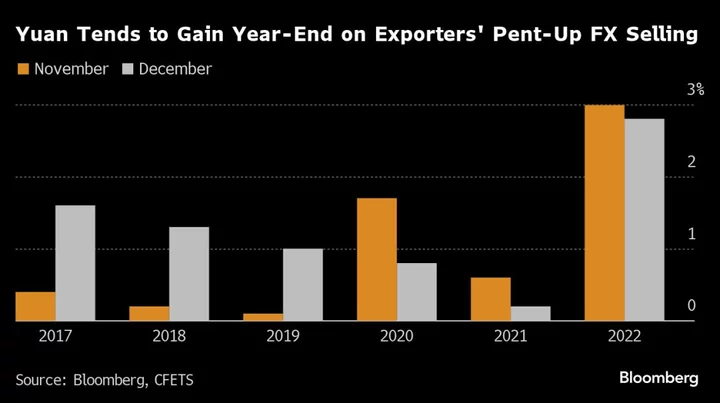

The currency has strengthened in both November and December in each of the past six years, with the biggest gains coming in 2022, according to data compiled by Bloomberg. The yuan tends to rise in these months as exporters need more local currency to meet cash demand before year-end and Lunar New Year, China International Capital Corp. said in a report.

The yuan has been one of Asia’s worst-performing currencies this year, meaning many companies have been waiting for more favorable conditions to convert their dollar deposits. With the yuan now set for the best month in a year amid a faltering greenback, exporters may start to flip that playbook, bolstering optimism over a sustainable turnaround.

“The dollar gauge is the key to sustain the yuan rally,” said Neo Wang, managing director for China research at Evercore ISI in New York “For foreign-exchange settlement, we see December as the peak month and seasonality will likely bolster the yuan gain against the dollar toward year-end.”

Speculation the yuan has broken its long downward trend is building, with some analysts predicting the currency will extend gains toward 7 per dollar, a level last seen in May.

Official Support

Pessimism toward Chinese assets has also begun to recede as officials step up support for the ailing property sector and geopolitical risks abate.

The yuan continues to be supported by Beijing’s fixing guidance even as the dollar starts to weaken. Officials bolstered currency support last week, boosting the currency beyond the reference rate for the first time since July. The onshore yuan closed Friday at 7.1488, rising 0.9% over the week.

“We remain relatively constructive on the yuan into year-end and in 2024, given that the macro outlook appears to be stabilizing and yuan seasonality also favors in the rest of the year and in the beginning of the year,” says Xiaojia Zhi, head of research at Credit Agricole CIB in Hong Kong.

--With assistance from Mia Glass and Qizi Sun.