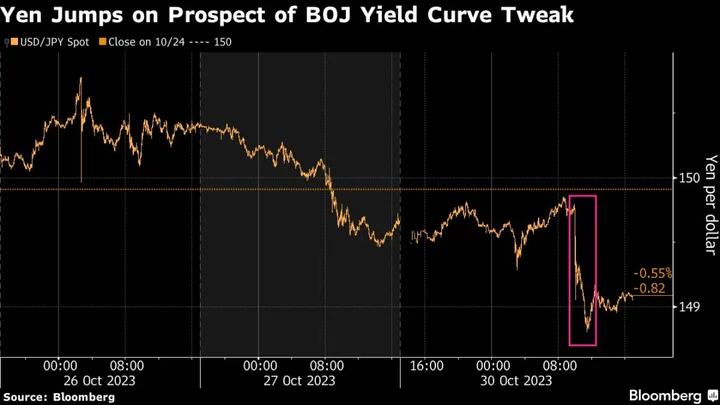

The yen rallied on a report that the Bank of Japan may raise a cap on government bond yields, adding a layer of uncertainty as policymakers in Tokyo wrap up a two-day meeting. Asia stocks are poised for a mixed open.

Japan’s currency rose to its highest level in nearly three weeks after Nikkei reported, without identifying where it obtained the information, that the BOJ is considering letting the yield on 10-year government bonds rise above 1%. Ten-year swap rates also jumped on the report.

That news rippled across Asian markets, with futures for equities in Japan and Hong Kong turning lower. Contracts for Australia also took a hit before bouncing back following broad gains in the US, where the main benchmarks climbed more than 1%. Meanwhile, the Golden Dragon index, which tracks the largest Chinese firms listed in the US, gained for a third day.

The yen’s slide last week to a fresh year-to-date low, higher yields and continued inflation stickiness have been spurring market speculation that the BOJ will make some adjustment to the yield-curve control at its meeting, which concludes Tuesday. The currency was little changed in early Asia trading.

In the US on Monday, stocks rose as Israel’s ground incursion into Gaza appeared less extensive than investors had feared. Amazon.com Inc. led gains in the beaten-down megacap space, though Tesla Inc. bucked that trend — dropping almost 5%.

Oil erased its gains since the war in the Middle East began as Israel faces growing pressure to curb its bombardments to help hostage negotiations, keeping the conflict limited entering its fourth week. West Texas Intermediate settled below $83 a barrel.

“The operation isn’t as large as feared yet — and that’s helping to slightly reduce geopolitical anxiety,” said Tom Essaye, a former Merrill Lynch trader who founded The Sevens Report newsletter. “This week will be a very busy one as we get a Fed decision and important economic/inflation data, as well as the final ‘big’ week of earnings.”

Treasuries fell, briefly paring some US session losses after the Treasury Department reduced its estimate for federal borrowing for the current quarter on stronger-than-expected revenues.

Key events this week:

- China non-manufacturing PMI, manufacturing PMI, Tuesday

- Bank of Japan interest rate decision, Tuesday

- Eurozone CPI, GDP, Tuesday

- US Conference Board consumer confidence, employment cost index, Tuesday

- China Caixin manufacturing PMI, Wednesday

- UK S&P Global / CIPS UK Manufacturing PMI, Wednesday

- US construction spending, ISM Manufacturing, job openings, light vehicle sales, Wednesday

- All Saints holiday in much of Europe, Wednesday

- Treasury quarterly refunding announcement, Wednesday

- Federal Reserve interest rate decision. Fed Chair Jerome Powell holds news conference, Wednesday

- Eurozone S&P Global Eurozone Manufacturing PMI, Thursday

- Bank of England interest rate decision. Governor Andrew Bailey holds news conference, Thursday

- US factory orders, initial jobless claims, productivity, Thursday

- Apple earnings, Thursday

- China Caixin services PMI, Friday

- Eurozone unemployment, Friday

- US unemployment, nonfarm payrolls, Friday

- Canada employment report, Friday

Here are some of the main moves in markets as of 6:42 a.m. Tokyo time:

Stocks

- The S&P 500 rose 1.2%

- The Nasdaq 100 rose 1.1%

- Hang Seng futures fell 0.5%

- S&P/ASX 200 futures rose 0.4%

- Nikkei 225 futures fell 0.4%

Currencies

- The Bloomberg Dollar Spot Index fell 0.4%

- The euro was little changed at $1.0616

- The yen was little changed at 149.08 per dollar

Bonds

- The yield on 10-year Treasuries advanced six basis points to 4.89% on Monday

Commodities

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.