Bank of Japan Governor Kazuo Ueda’s dovish stance has cemented the yen’s status as the most attractive funding currency for carry traders, a factor which is helping add to its weakening trend.

Thanks to the BOJ’s negative-rate policy, the yen stands alone in terms of low implied yield — a gauge of funding costs — with a three-month rate of minus 0.4% compared to the 30 other currencies analyzed by Bloomberg which have yields above zero. That’s about 180 basis points below the Swiss franc, another popular funding currency.

A proxy of sorts for the yen carry trade — lending in the currency by foreign bank branches in Japan to their offices abroad — has climbed 48% since the end of 2021 to 12.9 trillion yen ($92.4 billion) at the end of April.

Carry traders take advantage of the difference in interest rates between two economies to borrow where the rate is low and invest where it’s high. While speculation lingers the BOJ may tweak its yield-curve control program this summer to make it more sustainable, Ueda’s commitment to negative rates is what’s key for any carry strategy involving the yen.

“Low yields in Japan make the yen a preferred funding source,” said Tsuyoshi Ueno, a senior economist at NLI Research Institute in Tokyo. “Along with Japan’s trade deficits, demand for carry trades will limit any strength in the yen.”

After starting 2023 on the front foot, the Japanese currency soon resumed last year’s weakening trend and is down over 6% against the dollar ahead of Friday’s key BOJ policy announcement. More than half of the economists surveyed by Bloomberg expect the central bank to leave Japan’s minus 0.1% short-term rate unchanged for at least the rest of this year.

BOJ’s Ueda Likely to Hold With Bond Market on His Side For Now

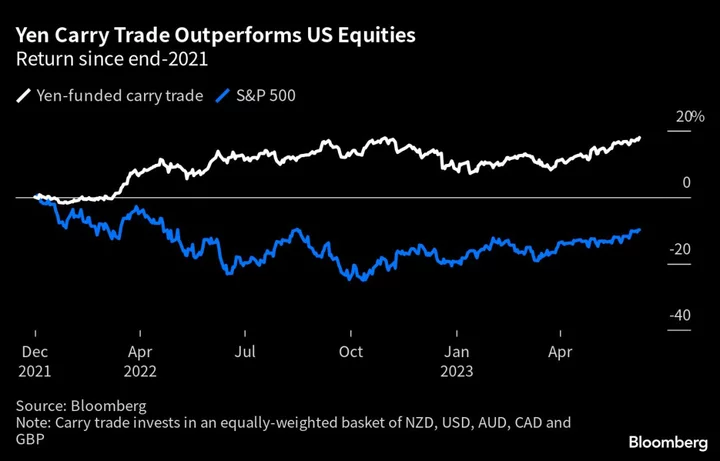

A carry trade selling the yen and going long an equally-weighted basket of the New Zealand, US, Canadian and Australian dollars as well as the pound has gained 19% since the end of 2021, compared with an 8% loss in the S&P 500 index.

Still, a look at the euro and Swiss franc, common sources of carry funding, is instructive to yen traders for when the BOJ eventually normalizes policy. Implied yields on those currencies surged after the European Central Bank started policy tightening last July and its Swiss counterpart ended negative rates in September.

Aside from a surprise BOJ policy shift, a risk to any yen-based carry strategy would be a jump in market volatility which can wipe out gains. But a Deutsche Bank gauge of expected currency fluctuations has fallen to the lowest since February 2022 this week, suggesting the environment is favorable on the volatility front.

“There’s a good potential for the carry trade especially when volatility drops,” said Shusuke Yamada, head of Japan currency and rates strategy at Bank of America. “Market players are quite convinced that the low yield will continue in Japan for an extended period.”