Treasury Secretary Janet Yellen said a cooling — but not faltering — labor market is playing a key role in helping to slow US inflation, among a raft of factors imposing disinflationary pressures.

“The intensity of hiring demands on the part of firms has subsided,” Yellen said Tuesday in an interview with Bloomberg News. “The labor market’s cooling without there being any real distress associated with it.”

Along with job-market shifts, Yellen cited housing costs and vehicle prices among factors that are likely to keep pushing down cost pressures. She also suggested that corporate profit margins could play a role. At the same time, she urged against excessive optimism based solely on June’s consumer price data.

The improvement in the inflation landscape comes as welcome relief for Yellen and the Biden administration after they bungled the issue in 2021. Yellen initially said the burst in prices triggered by the pandemic would be “transitory,” a forecast she later characterized as a mistake.

Receding inflation has prompted economists and investors to reassess recession risks. Goldman Sachs Group Inc. on Monday scaled back its estimate of the odds of a downturn to 20%, from 25% previously. And JPMorgan Chase & Co.’s Marko Kolanovic, who started turning bearish on markets last December, said the path to a soft landing is “modestly wider.”

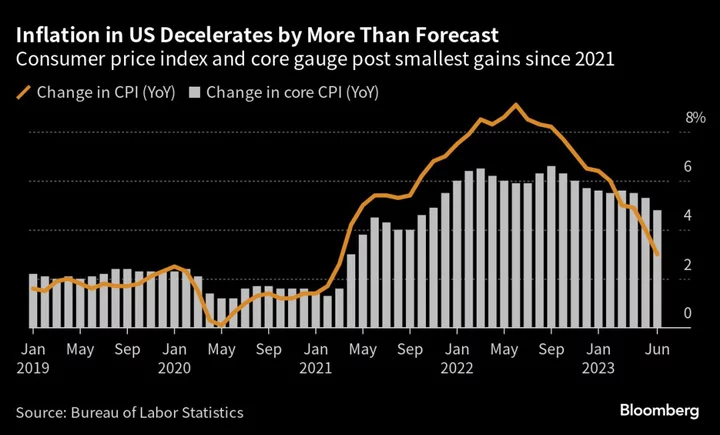

Last week’s consumer price index report showed a year-on-year gain of 3%, the smallest since March 2021 — when the US was in the very beginning of the pandemic inflation surge. That’s well down from the peak above 9% in June last year. Excluding food and energy, the core CPI was up 4.8% from a year before.

In the interview, Yellen cautioned against reading too much into the June data, calling it “one month’s numbers.”

But she saw other positive points in the underlying data, especially in housing, that she thinks will continue.

“Housing had a reduced contribution, and there’s every reason to believe that that will continue and come down further,” she said. “That’s an important thing that influences core inflation.”

Rent inflation in the US has been slow to drop because of the length of typical leases.

In goods, where prices fell on a month-over-month basis in June, Yellen pointed to autos as an important factor providing signals about supply chains that Covid so deeply disrupted.

Supply Chain

“Used cars have been a significant contributor” in the reduction of core inflation, she said. “Inventories are being rebuilt. The whole supply chain in autos is improving. So there’s reason to believe that we could get some continued benefit from that.”

The improvement in US inflation trends has contrasted with suggestions of outright deflationary risks in China. The Treasury chief on Monday said while China’s slowdown could have negative spillovers, she still saw the US averting a recession.

Read More: Yellen Says China Slowdown Risks Spillovers But No US Recession

The jobs market remains crucial for President Joe Biden and his re-election hopes next year. Biden needs inflation to fall, but without the Federal Reserve’s aggressive rate increases — 5 percentage points of hikes since March 2022 — triggering a recession or significant rise in unemployment.

Yellen has consistently said it’s possible to bring inflation back to the Fed’s 2% target without a spike in joblessness, a view that has been seen as overly optimistic in some quarters.

But so far, the labor market has proved remarkably strong. Unemployment remained at 3.6% in June, near a half-century low.

“We’re not seeing firms actively reduce” their headcount, “except in a few hard-hit sectors, like tech,” Yellen said. “We’re not seeing them lay off workers, it’s just the intensity with which they’re trying to add to their workforce seems like it’s reduced somewhat.”

She also cited a drop in job openings.

Despite wage growth that continues to contribute to inflation, she said she believes it may not be absolutely necessary to rein wages in to further temper price rises, alluding to the potential for reduced corporate margins.

“Profit margins are also quite high, and they have some cyclical dimension,” she said. “So, I don’t want to go so far as to say you couldn’t see inflation come down without further moderation in wages.”

Lael Brainard, the White House National Economic Council director, was more direct, last week calling on companies to “bring their markups down.”

Yellen was speaking on the sidelines of meetings in India with finance chiefs from around the world. She departs India Tuesday for two days of meetings in Vietnam with government and business leaders.