Turkish President Recep Tayyip Erdogan has promised a team with “international credibility” to manage the nation’s finances. Given his influence over everything from interest rates to infrastructure, how much credibility is unclear as market pressure builds.

A new cabinet is expected to be named at the end of the week after Turkey’s longest-serving leader extended his rule by another five years. The most significant potential appointment would be Mehmet Simsek, a former finance minister who advisers to Erdogan have been courting to oversee economic policy, people close to the matter said.

Investors have bemoaned Erdogan’s maverick approach, underpinned by his belief that the only way to tackle inflation is to cut borrowing costs and grow the economy. The key question for the outside world is whether more Erdogan means more of the same or whether Turkey will shift toward policies that are more attuned with global economics and his NATO allies.

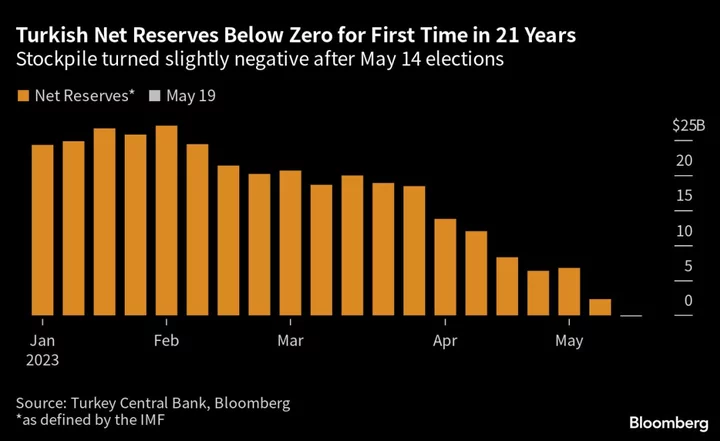

The lira extended its slump toward record lows against the dollar after he prevailed in a runoff vote on Sunday to complete a triumph that opinion polls hadn’t predicted a few weeks ago. The main issue is Turkey’s external financing, with the country having depleted its foreign currency reserves and with more than $200 billion of debt payments coming due.

“Despite the economic challenges faced by Turkey, Erdogan is unlikely to delegate responsibilities and soften his highly personalized style of rule,” said Anthony Skinner, head of research at global advice firm Marlow Global. “He may appoint one or two senior officials who are palatable to the markets, but it is clear who will continue calling the shots.”

Simsek, 56, a former Merrill Lynch strategist, has asked for the autonomy that would allow him to put the country’s finances back on track, the people said. They asked not to be identified citing sensitivity of the matter.

Erdogan’s spokesman Ibrahim Kalin told AHaber TV on Monday that Simsek would “continue to contribute to policies on economy” regardless of whether he became part of a new cabinet. Simsek, who joined Erdogan on the campaign trail earlier in the month, said he wasn’t seeking a return to “active politics.” Erdogan and Simsek met in Ankara on Monday, according to two people familiar with the discussions.

Ceding Control

The power that Simsek demands is mostly about monetary policy, which has been in line with Erdogan since the new central bank governor took over in March 2021. The gap there may be too big to bridge, the people said.

The ruling AK Party’s outreach to Simsek is already making waves in national media. Pro-government newspaper Sabah said Erdogan was planning to bring back the old guard to run Turkey’s economy. Former Ministers Cevdet Yilmaz and Lutfi Elvan would both take part in the new economic administration under Simsek, according to one of its top political commentators.

Erdogan’s grip on the economy was cemented with a constitutional overhaul in 2017. He abolished the office of prime minister and consolidated all executive power, wielded by his handpicked inner circle. Central bank governors were appointed and dismissed, finance ministers likewise.

The economy grew 5.6% last year, one of the fastest rates in the Group of 20. Inflation, though, hit 86% — and the central bank kept cutting the cost of borrowing. Prices are rising at half that pace now, yet still by more than anywhere in the G-20 except Argentina.

Investors have gotten used to an unpredictable mix of regulations and interventions that prompted many to dump Turkish securities. Total foreign holdings of stocks and bonds plummeted by about 85%, or nearly $130 billion, since 2013.

Next Vote

On the horizon are local elections next year. Erdogan and his AK Party are aiming to wrest back control of the biggest cities of Istanbul and Ankara from the opposition. That makes government spending cuts or other austerity measures unlikely, according to economists.

In turn that will affect foreign policy because Turkey has been reliant on money from Russia and the Gulf states to help prop up the lira, said Ozgur Unluhisarcikli, Turkish head of the German Marshall Fund of the United States. “Making sure the support from these countries will remain a priority in the upcoming period,” he said.

Erdogan, 69, extended his 20-year rule after defeating rival Kemal Kilicdaroglu by 52% to 48%. That victory was set in motion two weeks earlier when Erdogan defied expectations to secure a significant lead in the first round while his alliance of parties garnered a majority in parliamentary elections.

Following that result, the lira declined toward a symbolic 20 to the dollar. Morgan Stanley warned it may slide toward 28 by the end of the year should Erdogan decline to change course.

Turkey needs to address its vulnerabilities, though that is now more likely to happen later in the year, according to Selva Bahar Baziki at Bloomberg Economics. “We expect a shift in economic policies toward orthodoxy,” she said. “But the pivot will probably fall short of what the economy needs.”

--With assistance from Cagan Koc, Beril Akman and Selcan Hacaoglu.

Author: Onur Ant, Kerim Karakaya and Firat Kozok