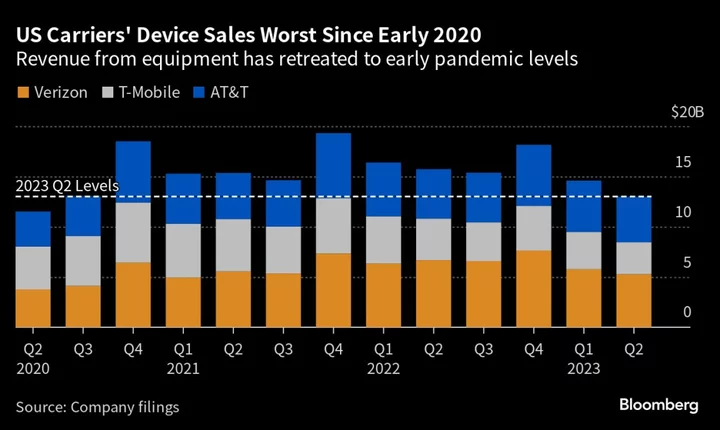

The top three US wireless carriers have lost billions in revenue as smartphone sales dwindle in a reversal of the pandemic boom.

AT&T Inc., T-Mobile US Inc. and Verizon Communications Inc. collectively lost nearly $5 billion in equipment sales over the past 12 months compared to the previous year. T-Mobile’s equipment revenue fell 23% last quarter, while AT&T’s slipped 7% and Verizon’s postpaid phone upgrades dropped 34%.

Executives partly blame smartphone makers and say customers are content waiting longer between upgrades. Verizon Chief Executive Officer Hans Vestberg said on a recent earnings call that there hasn’t been any “major” new devices recently, while T-Mobile Chief Financial Officer Peter Osvaldik said customers are “happy with their devices” for longer time frames.

The turnaround comes after a surge in demand of wireless devices during the Covid-19 pandemic — revenues hit about $6 billion per carrier in the last quarter of 2020 when stimulus checks, product promotions and nationwide lockdowns spurred consumers to upgrade their electronic devices. Now, consumers have returned to pre-pandemic upgrade cycles as networks pull back on promotions.

Almost a third of new phone buyers in March had kept their old device for at least three years, up from just 20% in March last year, analysis by Consumer Intelligence Research Partners shows. The average age of a North American’s smartphone rose to three-and-a-half years last quarter, according to Assurant Inc. Earlier this month, Apple Inc. posted its third straight quarter of declining sales, while other phone makers, including Samsung Electronics Co., have also seen sales of their devices slow or remain flat.

The decline in revenues isn’t necessarily bad for telcos. “Lower equipment sales are a good thing for the carriers,” New Street Research LLP Managing Partner Jonathan Chaplin said, as they often lose money on smartphone sales due to promotional discounts. “If the upgrade rate declines, they are subsidizing fewer handsets, and their margins expand,” he said.

Still, less enticing smartphone upgrades could pose a problem for the wireless carriers’ all-important service revenues, making up about three-quarters of total sales, as they rely on offerings like free phones to bring in new customers and fuel growth.

New Street’s Chaplin sees upgrades and equipment revenues continuing to decline through the end of the year absent a “blockbuster” iPhone launch in September or October. Though even Apple Chief Executive Officer Tim Cook has limited visibility: “It’s very difficult to estimate real time what is going on with the upgrade cycle,” he said on a recent earnings call.

Slowing subscriber growth has weighed on carriers’ shares this year. AT&T is down 23%, Verizon has dropped 16%, and T-Mobile, which recently had its best second quarter in eight years, is down about 1%.

--With assistance from Scott Moritz.