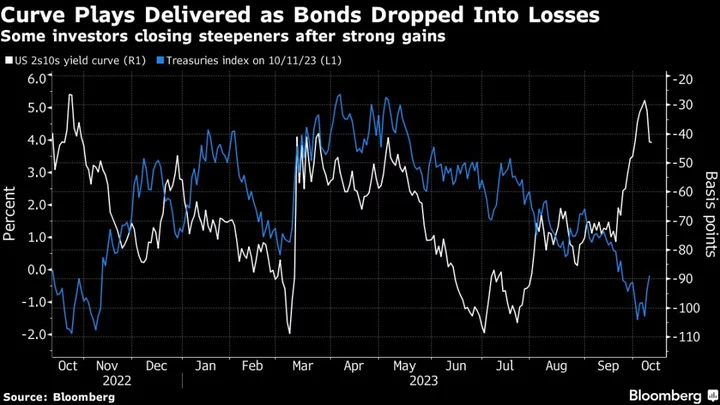

Bond investors are starting to back away from what’s been one of the few bright spots for them this year amid signs yields may have peaked after the epic rout in September.

Money managers at Schroders Plc and Pendal Group in Sydney just closed out some so-called curve steepeners — which pay off when shorter-dated debt outperforms longer bonds. Those trades delivered gains in recent months despite a selloff in bonds spurred by hawkish Federal Reserve wagers.

“Our US steepener view has been our best performing trade this year,” said Kellie Wood, deputy head of fixed income at Schroders. “This position protected our modest long duration view that underperformed over the last quarter as we positioned for the end of the US policy cycle.”

The firm closed that steepener trade this week. “We moved flatter through the US curve with the back end sell off steepening the curve,” Wood said.

Market watchers had been disconcerted as the US curve went through a so-called bear steepening in the second half of the year, a scenario where an increase in longer-dated yields leads the shift. The moves came as a resilient US economy boosted the risk that the Fed will hold rates high for some time.

Shifting Bond Yield Curve Scrambles Market’s Recession Signal

However, recent comments from Fed officials suggesting they don’t see the need for further rate increases are reviving bets that the worst of the Treasury selloff may be over. That’s drawing investors to buy and hold bonds at attractive levels, after bearishness toward the asset class sent the average yield on a Bloomberg index above 5% for the first time since 2007.

The shift is already underway. The gap between US 10-year and two-year yields closed at minus 28 basis points on Friday, up from less than minus 100 in mid-July. In Australia, the gap between 10- and three-year rates, peaked at 62 basis points on Monday, from about zero in July. The difference between New Zealand’s two and 10-year yields reached minus 20 basis points this week, the highest since November.

Going Long

Pendal’s Amy Xie Patrick is trimming positions that bet short-term Australian bonds would outperform longer-dated ones. Australia’s curve briefly inverted around the middle of this year, but the extra yield that longer-dated bonds offer over shorter-dated ones has doubled since she put on the initial trade.

“The momentum feels exhausted” for those bets, said Xie Patrick, head of income strategies at Pendal. “Probably much like the bond bearish momentum overall.”

Schroders is now running a position that is long two-year Treasuries and short 30-year US bonds. “That’s a structural position — inflation and government spending keeping long term interest rates higher,” Wood said.

Pendal’s Xie Patrick is starting to look more favorably on simple long positions for bonds, though she’s reluctant to go there yet.

“I’ll be looking to extend more meaningfully my duration position in the first half of next year if not the first quarter,” she said. The strong steepening move means you aren’t sacrificing so much on the income side, because the yields on longer-dated bonds are now offering a smaller discount to shorter-dated peers, she said.