You would expect a £10 ($13) bottle of wine to be a little better than a £7 bottle.

But those extra £3 could make it twice as good a bottle, according to UK winemakers. That’s primarily because of the way alcohol duties have been structured in the UK for years.

Now that formula has changed, thanks to new duties that start today.

In this year’s spring budget, Chancellor of the Exchequer Jeremy Hunt announced a shake-up on alcohol duty. Instead of imposing a tax based on the product (for example, wine, beer or spirits), the tax—which had been frozen since the 2020 August budget—is now based on the strength, or the drink’s alcohol by volume (ABV). For a bottle of 12.5% ABV still white wine, this means the duty will increase by 44 pence a bottle, or 20%, from £2.23 to £2.67. The tax on fortified wines will increase even more, given their higher alcohol content.

The Wine and Spirit Trade Association has called it the “biggest single duty hike since 1975.”

Which means, if you’re looking for wine that’s both good quality and good value, you’ll probably be selecting different bottles than you were before.

Are £8 Wines Now “Undrinkable”?

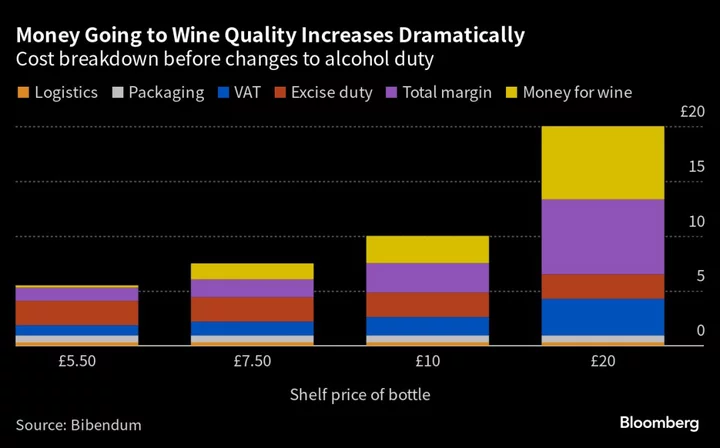

Alcohol duty is a regressive tax. Rather than being based on the wine’s price tag, it’s charged by unit of alcohol— meaning that a £5 bottle of 12.5% ABV wine could be subject to the same amount of duty as a £1,000 bottle with the same ABV. That means a substantial chunk of the sale price of a cheaper bottle is going to the exchequer—but a much smaller proportion of the cost of a pricier one.

Figures calculated before the duty change by wine supplier Bibendum found that because of tax and other fixed costs, including packaging and shipping, just 21 pence of a £5.50 bottle are related to the wine itself. That more than tripled to 70 pence for a £6.31 bottle. For a £7.50 bottle it rose to £1.46; for a £10 bottle, to £2.48.

Therefore, a wine’s quality could increase dramatically once you spent a little more at the lower end of the market. “There’s a point at £8 to £9 a bottle where the quality gets much better suddenly,” said Roy Gillingham, owner of Fareham Wine Cellar, a vintner in Hampshire.

However, the amount of money that goes to winemakers will change as duties go up.

Gillingham is increasing the price of normal-strength—11.5% to 14.5%—still wines he sells by 50 to 60 pence to cover the increase of the 44 pence plus value-added tax (VAT). Because of that, he recommends avoiding the now-less-than-£8 wines, which will be “virtually undrinkable,” as an even lower proportion of the shelf price will be going to winemakers to create a quality product.

“In an honest world you need to spend £12 to £14 to get a really nice bottle,” Gillingham added. Other wine sellers agree. Seb Evans, co-founder of Winedrops, an online wine seller, said that spending £10 to £15 per bottle is now the best value for money, while Harriet Kininmonth, wine trading director at C&C Group, said that at £12 you can get a “pretty good wine” that she would be happy to serve to her friends.

Lower-ABV Wines

Some experts believe this will encourage producers to make wines weaker because rates for the new alcohol duty depend on the ABV.

In a survey done by Proof Insight, a UK market research group, 27% of shoppers said they would prefer the alcohol level to be reduced to maintain the current price of their wine after the duty change. They also ranked the ABV as only the 12th most important consideration when they buy wine, with the grape variety, color and price the most important.

Kininmonth said she expects the new tax system will encourage winemakers to make lower-strength wine over time, especially for the entry-level part of the market that’s particularly price sensitive. “They will pay progressively less duty, offering better value for money and tapping into the moderation trend,” she said.

She added that “all retailers are reviewing their entry-level ABVs.” She expects all “house- and entry-level [wines] will drop below 11.5% ABV in national accounts.”

This could mean two things. First, it might lead to a preference for wines that have a naturally lower alcohol level like gamay, Muscadet or riesling. Wines produced in colder climates also tend to have a lower ABV. However, Gillingham said this is becoming more difficult because of climate change. He estimates the average Alsatian wine has gone up by 1 ABV percentage point in the last 30 years. “The grapes get ripened more than they used to,” he said.

The other approach is to mechanically remove alcohol from the wine after production. Kininmonth said her group is working with a New Zealand supplier that uses “spinning cone” technology: a machine that spins wine to either completely or partially remove alcohol.

“Our advice to suppliers is to manage your alcohol down—every half a percent will make a difference to the cost of wine in the UK,” she said.

Top Value Regions

Another option is to seek wine regions that offer the best value for money. Evans recommends Portuguese wines for value. “The whites in particular are for the average consumer quite attractive. They’re not too strong, quite fruity, easy drinking for the summer,” he said. Gillingham agreed: “Portugal is a great undiscovered region because [shoppers] don’t understand the grape names so they ignore it.”

Kininmonth’s recommendations are similar: vinho verde from northern Portugal, Beaujolais or German riesling.

Whatever you do, Gillingham has one piece of advice: “Life is too short to drink cheap wine.”

Author: Helen Chandler-Wilde