There are about 150,000 public electric vehicle chargers of various sorts in the United States, according to a recent report by S&P Global Mobility. If you think that sounds like a lot, you have no idea what's on the way.

By 2030, there will need to be more than 2.1 million public EV chargers to support an expected 28 million electric vehicles on America's roads, that same report finds. With the US electric vehicle industry on the cusp of rapid expansion, Ford and General Motors, together with Tesla, recently made alliances that will change the future development of EV charging.

Ford and GM are going to start allowing their electric vehicles to use Tesla chargers and, in the future, will even build their vehicles with charging ports -- the place on the vehicle where the EV charger plugs in -- based on Tesla's design standards. That means they'll be able to use Tesla chargers seamlessly without an adapter.

That's a big change. Up until now, America's electric vehicles have mostly used one of two types of chargers. There was Tesla, with its own proprietary network of about 17,000 public chargers. Then there was every other EV maker which used the Combined Charging System, or CCS, format for fast charging. (Then there's the Nissan Leaf which uses something called CHAdeMO, sort of the LaserDisc to everyone else's VHS and Betamax.)

Will other automakers follow?

While Tesla is, by far, the biggest seller of EVs in America, Ford and GM are a distant second and third. So now, America's three biggest EV makers are using a charging format that's different from all the other automakers. The question now is, who else will follow?

Or will everyone follow, like a line of dominoes toppling?

"I think it's too early to say," how many other automakers will join with GM and Ford, said Stephanie Brinley, an analyst for S&P Global Mobility, "but it certainly pushes in that direction."

This is what is means for the EV driver:

Greater reliability

Tesla chargers are widely regarded as being much more reliable than others. That was an important factor in GM's decision, said Jon McNeill, a former Tesla executive and now a GM board member and founder of DVx Ventures, a venture capital firm.

"I think what GM realized is, to get people to adopt EVs, chargers need to be reliable and widely available," he said. "And Tesla's standard works. Ninety-nine times out of 100 times you go to a charger, it works."

He compared that to other chargers with which, in his estimation, a charging session can't be started, for one reason or another, about one time in four. This roughly aligns with a recent JD Power study indicating a failure rate of about one in five.

But other EV charging companies have, so far, faced a far greater reliability challenge than Tesla's.

"Tesla designed the cars and the chargers at the same time to work with each other. It's an integrated system and has been from the very beginning," said Jim Burness, chief executive of National Car Charging, a wholesaler of equipment to the EV charging industry. "I'll be curious to see if it is as smooth an experience when a Ford is plugging into a [Tesla] Supercharger."

Plugging in an electric car isn't like plugging in a toaster. It's not enough that the plug is the right shape. There is also software in the charger and in the vehicle that have to communicate and work together to make sure the vehicle is charging safely. All the major EV charger companies work with automakers and test their chargers with all the different major models, but problems and glitches can still happen.

As part of their agreement with GM, Tesla has committed to immediately sharing any charging-related software updates the vehicles need, GM vice president Alan Wexler said in an interview with CNN Business. These will be sent to the vehicles through over-the-air updates, just as they are for Teslas.

"They were forthright with committing to similar levels of performance for our vehicles and for Teslas," Wexler said.

Ford spokesman Dan Barbossa confirmed that the company had similar arrangements with Tesla, in response to a question from CNN. In both cases, drivers will be able to access Tesla chargers without having to use Tesla apps.

Prior to building their vehicles with Tesla-style charging ports, both Ford and GM will provide Tesla adapters with their vehicles. After the switch takes place, owners will still be able to use adapters to access CCS chargers, if they want.

Tesla, which generally does not answer media questions, did not respond to CNN's emailed questions regarding the Ford and GM arrangements.

More fast or slow options

These discussions are mostly about so-called Level 3 charging, or fast charging. They are not the the majority of chargers in America, but Level 3 chargers get most of the attention.

Depending on the specific vehicle model and other factors, they can charge an electric vehicles' battery pack to 80% in, often, about 20 minutes. They're usually intended for use by drivers who are on long trips and want to quickly recharge so they can back on the highway fast.

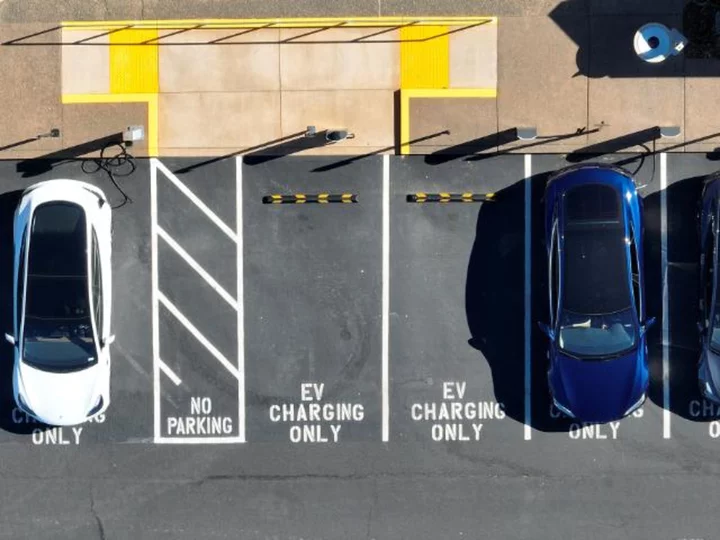

Level 2 chargers are far more common, but they get less attention, partly because they're just not as eye-catching. These usually look like a box bolted to a wall or a utility pole with a cable about the size of a garden hose. They're essentially the same sort of charger EV owners might have at home. They can take hours to fully charge a battery, but if the charger is in a place where people commonly spend some time, like at a movie theater or near restaurants, EV owners will plug in and get some electricity while they can, like plugging in your phone while you're sitting at your desk.

Tesla units are much less common among these chargers, which is why you'll often see Teslas plugged into non-Tesla slow chargers.

GM and Ford's arrangement with Tesla is "not an issue for us at all," said Brendan Jones, CEO of Blink Charging, a company that mostly operates level 2 chargers.

"Tesla customers have been using Blink chargers on their vehicles for years and years and will continue to do so," he said. "So will GM and Ford customers."

Still, Blink has already announced plans to start producing its own chargers with NCAS connectors along with CCS-like cables. Other charging companies, for both fast and slow chargers, have made similar announcements.

Longer lines?

Still, Tesla stands to gain in the charger business as automakers move to its format, Burness said. And even as other charging companies add Tesla-style charging cables, many people will still opt to find the brand-name Tesla chargers that they've come to understand are most reliable.

That could lead to more lines at Tesla chargers, irritating Tesla owners.

"That's going to be a moment of frustration for them because there's no benefit to them of opening up the network," said Stephen Beck, managing partner of cg42, a consumer experience consulting company.

But Tesla is likely to make plenty of revenue from all those extra charging sessions.

Tesla "is going to get, I don't know, $2 billion to $3 billion of revenue just from these folks a year," said Gary Silberg, a global automotive industry analyst at KPMG.