Wells Fargo & Co. and JPMorgan Chase & Co. led the biggest Wall Street banks in tapping the US investment-grade market after reporting third-quarter earnings.

The Wall Street giants borrowed from the debt market after posting strong net interest income and raising their outlook guidance. Wells Fargo issued $6 billion of bonds in two parts while JPMorgan priced a $7.25 billion, three-part offering, according to a person with knowledge of the matter.

Big banks were expected to stay on the sidelines because they’re well-funded for the short term and borrowing costs remain high. The average spread on a financial institution bond was at 145 basis points as of Friday, 21 basis points wider than the spread for the broader high-grade bond index, according to data compiled by Bloomberg. Banks still choosing to borrow may be a sign that they expect it to become more expensive to do so in the future.

Issuance from the two banks on Monday is likely driven by their needs to meet their total loss-absorbing capacity requirements, according to Bloomberg Intelligence analyst Arnold Kakuda. The so-called TLAC rules require banks to hold a certain amount of debt at the level of their holding companies, which can be converted to equity in a distressed scenario to keep the operating company solvent, or close to solvent.

Wells Fargo and JPMorgan are most impacted by the new regulations, which would affect their debt surpluses, Kakuda said.

“Regardless of higher borrowing costs, big banks need to replenish their bail-in eligible debt for regulatory purposes,” said Kakuda. “Banks have also raised the yield on their loans, but net interest margins may have peaked as lenders raise their deposit costs.”

Average yields on US high-grade company notes ended Friday at 6.1% after surging to the highest level since 2009 earlier this month.

Read More: Blue-Chip Bond Yields Hit Highest Since 2009 as Fed Teases Hike

Recent earnings from big banks have been supportive for credit spreads, which could lead to more issuance down the road, according to Robert Smalley, a financials credit desk analyst at UBS Group AG. Wells Fargo beat analysts’ expectations for net interest income in the third quarter and raised its full-year guidance again as it continues to benefit from higher interest rates. Meanwhile, JPMorgan posted another quarter of record net interest income and boosted its forecast for the year.

Read More: JPMorgan Returns to Green Bond Market as Sales Hit Record Pace

“More issuance should be anticipated,” Smalley said via email. “Neither Goldman nor Citigroup have issued a 10-year senior benchmark in 2023.”

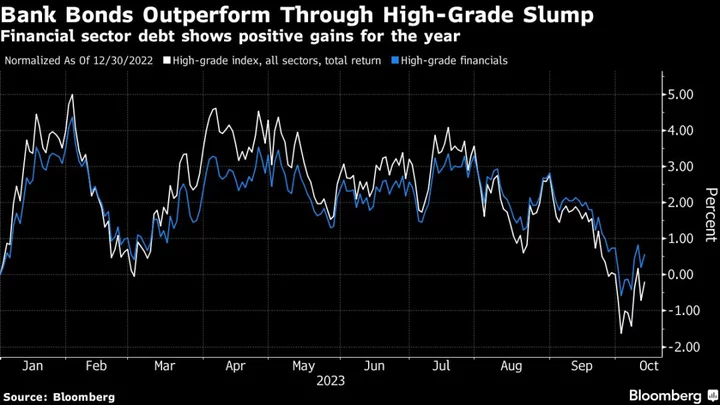

Investors also continue to be interested in debt issued by big lenders, as they’re considered a safe haven among financial sector credits, he added. Lack of supply has been a big driver of returns for financial-sector bonds so far this year.

Outlook

US companies have raised $22.15 billion so far this month, far less than the projected $85 billion. Earnings blackouts partly contributed to the slowdown, but issuance from the big banks should pick up as more lenders report quarterly results, JPMorgan credit strategists including Eric Beinstein and Nathaniel Rosenbaum wrote in a note on Monday.

The bank’s financial sector analyst Kabir Caprihan is projecting a total of $16 billion to $20 billion from the big banks post earnings and issuance could reach $24 billion by the end of the year, according to the note.

“If this proves correct it is not going to change the supply picture much, and it may help financials narrow their spread gap to non-financials,” the analysts wrote.

--With assistance from Christopher DeReza, James Crombie and Boris Korby.

(Updates with deal pricing details throughout)