South Africa’s central bank is reluctant to pivot away from policy tightening after raising its benchmark interest rate into restrictive territory amid rand weakness and government missteps that continue to fuel inflation.

The monetary policy committee delivered its first back-to-back half-point increase in 15 years in the wake of a diplomatic row between Pretoria and the US that weighed on South Africa’s currency and government bonds. The rand has also come under pressure because of power outages and logistics-network constraints that sapped economic growth, the slow pace of economic reforms and concerns about a deterioration in fiscal metrics.

“At the current repurchase rate level, policy is restrictive, consistent with elevated inflation and risks,” Governor Lesetja Kganyago said. That’s the first time he’s labeled the stance anything but accommodative in the current hiking cycle, which started in November 2021 and has seen they key rate more than double to 8.25%.

“We do not view this statement as an indication that it is done yet with hikes though,” said Jeffrey Schultz, BNP Paribas’s chief economist for Middle East and Africa. “There is a low-conviction view on the MPC right now on how quickly inflation can come back sustainably to its desired 4.5% target. This, we think, is backed up by its reiteration that rand weakness and vulnerability is ‘likely to persist for longer’.”

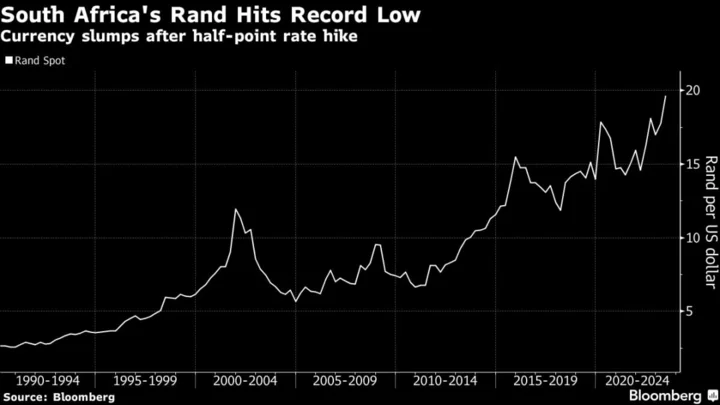

Kganyago’s warning of further rand weakness sent the currency plunging to a record low of 19.7640 per dollar.

“The rand, which has previously reflected confidence toward emerging markets, has now become a measure of South Africa-specific investor sentiment,” said EY Africa’s Chief Economist, Angelika Goliger.

The hiking cycle will only turn when the price-growth trajectory changes and inflation starts moving toward 4.5%, Kganyago said. He bemoaned high administered and regulated prices, including electricity and water.

If all public-sector price setters “play ball and only adjust prices in line with the inflation target, that will help to bring inflation down,” Kganyago said. “Absent all of those, the instrument that we have as the central bank is the policy rate and that is what we will deploy to deal with inflation.”

The governor also said the central bank has no intention of intervening directly in markets to alleviate pressure on the rand and stem rising bond yields.

“Today’s interest-rate meeting has not definitively closed the door on further interest rate hikes, particularly given the upward revision to core inflation and the unanimous call for a 50-basis point hike,” said Sanisha Packirisamy, an economist at Momentum Investments. “While it is difficult to assess whether or not we are overtightening at present, markets believe that interest-rate policy is already quite restrictive, particularly given the downbeat growth outlook.”

--With assistance from Rene Vollgraaff and Monique Vanek.