Israel’s central bank revised down its economic projections as the war with Hamas becomes a big drag on growth while still leaving interest rates unchanged, as policymakers focus on propping up the shekel after it fell to an 11-year low.

Updated projections from the Bank of Israel’s research department on Monday showed gross domestic product will expand 2.3% in 2023 and 2.8% in 2024, down from its previous view of 3% for both years. The outlook assumes the conflict is contained to the country’s south, and Governor Amir Yaron later said a wider war would affect its estimates.

Alongside the new forecasts, the monetary committee kept its benchmark at 4.75% for a third consecutive meeting, as predicted by most economists surveyed by Bloomberg. The shekel was little changed after the announcement.

Israel is reckoning with the economic costs of a crisis that jarred markets from bonds to foreign exchange and erased some $19 billion from the value of the country’s benchmark stock index. The fallout has prompted unprecedented interventions by the central bank with a pledge to sell as much as $30 billion to support the shekel.

The priorities that emerged signal policymakers are sidestepping rate cuts for now to avoid more pressure on the currency, following 10 hikes that started early last year when official borrowing costs were near zero.

In a statement accompanying its decision on Monday, the central bank didn’t indicate the likely direction of its next move.

“The interest rate path, and the use of additional monetary policy tools, will be determined in accordance with this purpose and with developments in the war, as well as with data on economic activity and the inflation dynamics, in order to continue supporting the markets’ stability and achieving the policy objectives and the needs of the economy, the central bank said.

While the shekel’s declines first began months ago with the government’s controversial effort to reduce the power of the courts, the shock of the conflict has accelerated its depreciation to the weakest levels in eight years.

The shekel has dropped every day since the Oct. 7 raid by Hamas killed hundreds of Israelis and prompted retaliatory strikes on Gaza. It’s among the world’s worst performers this month with a loss of almost 6% against the dollar.

As Israel geared up for a ground offensive in Gaza last week, Deputy Governor Andrew Abir said the monetary authority’s top priority was to steady the shekel, prompting analysts and traders to review their expectations that monetary easing could be in the cards.

The government is meanwhile planning a massive wartime stimulus program, with the budget deficit possibly widening this year to 3.5% of GDP.

“The situation remains fluid and uncertain, which means that the Bank of Israel could bring rate cuts forward should the projected negative impact on growth become more prevalent or longer-lasting than immediate FX depreciation risks,” Morgan Stanley analysts including Georgi Deyanov and Alina Slyusarchuk said in a note. The Wall Street bank moved its expectation of a first cut to January next year.

Though policymakers have pointed to the shekel’s depreciation as the main inflationary risk, the war could bring huge disruption to the economy that would hold back consumer prices by crimping consumer demand for goods and services.

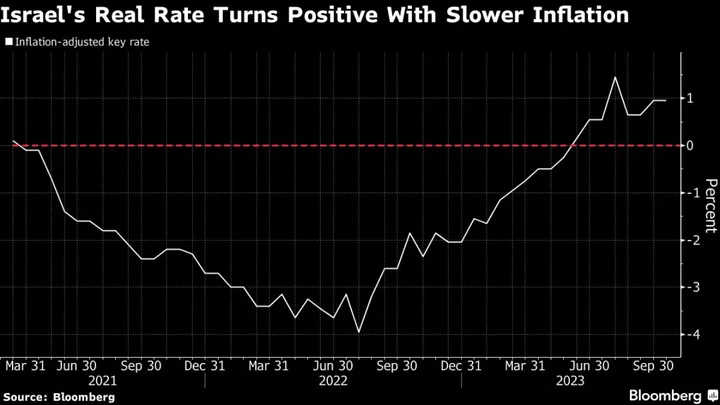

After hitting the fastest since 2008 at the start of the year, inflation has slowed almost every month since then to reach an annual 3.8% in September. The conflict will likely create “offsetting effects” on prices, according to Bank Leumi, which predicts the central bank will cut rates by “a limited degree” at one of its coming meetings.

“The purpose of the rate cut will be to support households, as well as the business sector, during this time of war, in light of the high degree of uncertainty,” analysts at the capital markets division of Bank Leumi said in a report.

--With assistance from Joel Rinneby.

(Updates with details of forecasts in second paragraph.)