As the trillion-dollar AI rally gathers pace, pity the humans on Wall Street trying to figure out this gravity-defying market.

With the S&P 500 Index staging an improbable 16% advance this year, being both bearish and wrong is making life awkward for the people paid to predict where equities will go next. After being blindsided by the resilience of the US economy thus far, humility is the order of the day for the sell-side pros who remain at loggerheads on what’s ahead.

Goldman Sachs Group Inc.’s David Kostin expects stocks will gain further, while Morgan Stanley’s Mike Wilson and JPMorgan Chase & Co.’s Marko Kolanovic have warned investors to stay away. At Bank of America Corp., there’s a disagreement under the same roof, with Savita Subramanian emerging as one of the most optimistic market voices as colleague Michael Hartnett says a renewed downswing is coming.

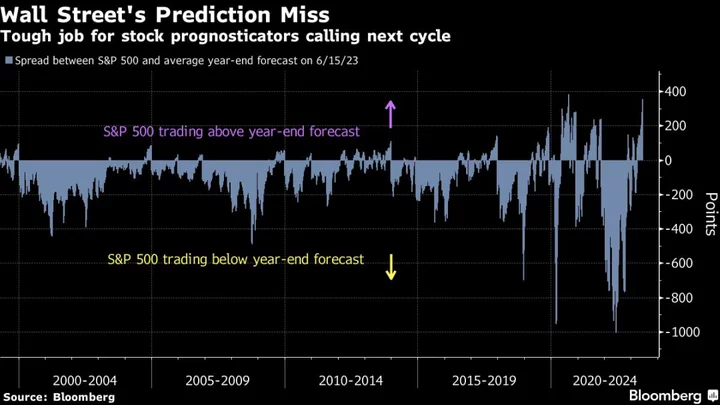

One thing’s for sure: The S&P 500 has already blown through its average year-end price target. Strategists are currently expecting the benchmark to end 2023 just below 4,100, with Friday’s 4,450.38 close leaving it 8.5% above that figure. The last time the gauge traded above the consensus target like this was in the pandemic mania of September 2020, according to data compiled by Bloomberg.

No wonder some equity analysts are sounding a little defensive, hoping their prognostications will be vindicated soon enough as hawkish Federal Reserve policy bites. Others are issuing words of humility to clients, expressing their temptation to nudge targets higher as the tech megacaps names surge higher.

Those who are getting things largely right are letting off steam, calling out naysayers for being too clever for their own good.

“Bears make you smart — but bulls make you money,” said BMO Capital Markets’ Brian Belski, who recently raised his end-year target to 4,550 from 4,300.

Narrow leadership, recession risk and downward earnings revisions are some of the key concerns leveled by skeptics. Plus, in the second half of the year something big could break in markets, or in the consumption and investment cycle – vindicating those currently cautious on risk assets. Yet, at least for now, the market continues to power higher and data suggests the economy can avoid a recession.

“I am certainly one of the investors who did not see it coming and did not expect it, even when it started, to last or go this far,” said Liz Young, SoFi’s head of investment strategy. “People that were cautious are kind of looking at the market and saying, am I missing something?”

At Citigroup Inc., Scott Chronert points to “a lack of concrete earnings revision support” in deciding not to jack up his target.

“As enticing as it may be to follow the tape and nudge our year-end target higher, we just do not see the fundamental justification for this, yet,” he said.

In these weird post-pandemic times — where the economic and market cycle upends conventional wisdom — bears who appeared to be geniuses one quarter risk looking like cranks the next. Meanwhile, those who’ve earned fame betting on the tech boom are more than a little paranoid that their bullish outlooks will seem bubblicious if things go south.

More broadly, when it comes to stock market calls, there are four quadrants: bullish, bearish, right, and wrong, according to Adam Parker, Morgan Stanley’s former chief US equity strategist.

“The worst quadrant to be in when you work at one of those firms is bearish and wrong because you didn’t really enable your upside capture for clients,” said Parker, who now heads up Trivariate Research. “I’ve been there, and I lived in all four quadrants – it’s a hard place to be.”

Piper Sandler’s Michael Kantrowitz is feeling the heat. He still sees the S&P 500 plunging to 3,225 by the end of this year, the gloomiest target out there. He has no plans to change his outlook, for now. In his view, the recent upward revisions to strategist targets resemble the momentum chasing in 2000 and 2007, when he says sell-siders pushed investors in front of a “proverbial bus.”

On the flipside, Oppenheimer Asset Management Inc.’s John Stoltzfus is enjoying better days. At one point last year he forecast the S&P 500 would end 2022 at 5,330. It closed at 3,839.5. This year he entered with a target of 4,400 — and he’s thinking about raising it while awaiting further inflation and employment data after the Fed skipped on a June rate hike.

When the market bottomed out in October, “what we think happened at that point is a lot of the negative projection that had been put out by the bears in 2022 essentially took everything that was wrong or uncertain and projected it into infinity,” he said. “That happens in bear markets.”

Meanwhile, Parker says it makes more sense to be cautious than it did seven months ago, given the rising stretch across US stocks and deteriorating credit. But abruptly shifting views risks undermining the credibility of a strategist’s framework.

“I just don’t think you ever want to be a perma-anything,” he said. “Because data changes, and I think you have to react to and absorb the new data and fit that into your thesis.”

--With assistance from Matt Turner, Mark Tannenbaum and Jessica Menton.