The biggest US lenders expect to pay almost $8.9 billion to help replenish the US government’s bedrock Deposit Insurance Fund after it was tapped to backstop uninsured depositors at Silicon Valley Bank and Signature Bank.

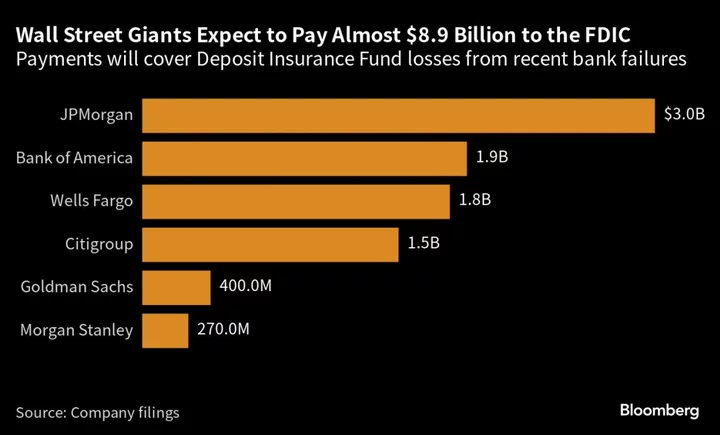

Citigroup Inc. expects to contribute as much as $1.5 billion to the Federal Deposit Insurance Corp.’s pot that was depleted to protect deposits at the two failed lenders, making it the last of the country’s biggest banks to disclose the set-asides. In total, the six largest lenders forecast covering 56% of the $15.8 billion it cost the FDIC to protect uninsured depositors. JPMorgan Chase & Co. expects to pay the largest fee, at approximately $3 billion, while Bank of America Corp. and Wells Fargo & Co. will each pay almost $2 billion.

The Deposit Insurance Fund typically covers only $250,000 in an individual bank account, but after Silicon Valley Bank and Signature fell into receivership in March, the FDIC, Federal Reserve and Treasury Department, perceiving a potential threat to the financial system, announced systemic risk exceptions for the two banks. That meant all depositors at the institutions would be made whole to prevent further destabilization.

Read More: Big Banks Face Billions in Extra FDIC Fees After SVB Failure

The fund had more than $128 billion in it at the beginning of the year — a pot that shrank with each bank failure. It’s usually filled and refilled by all insured banks kicking in quarterly fees knows as assessments, but when the government decided to cover uninsured deposits as well, it said that any losses to the fund would be recovered by a special assessment on banks, as required by law.

In May, the FDIC released a proposed rule outlining how the special assessments might be collected. The plan, which bases each institution’s fee on its estimated uninsured deposits as of December, excluding the first $5 billion, may be tweaked based on public comments, but, as it stands, big banks are on the hook.

The agency said institutions with more than $50 billion in assets would pay 95% of the fees, and those with less than $5 billion wouldn’t have to pay at all.

A week and a half before the proposal was released, First Republic Bank also failed, making an additional $13 billion dent in the Deposit Insurance Fund, the FDIC estimated at the time. But there won’t be a separate special assessment levied for First Republic, because the bank was quickly purchased by JPMorgan and a systemic risk exception wasn’t deemed necessary.

--With assistance from Hannah Levitt.