Warnings about the glum outlook for European equities next year are growing, with strategists at JPMorgan Chase & Co. and Sanford C. Bernstein joining those raising concerns about the impact of a slowing economy and interest rate hikes.

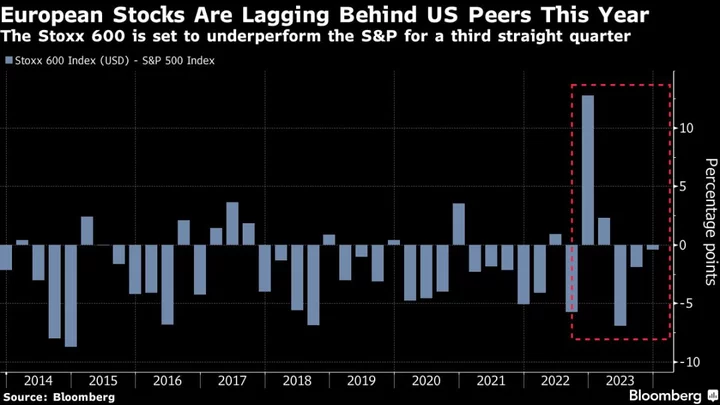

The latest comments reinforce the view that European stocks are set to continue to lag behind the US market in 2024.

JPMorgan strategist Mislav Matejka forecasts that the MSCI EMU Local Index, which tracks the shares of some 230 euro-zone companies, will end next year at around 256 points, down 2% from current levels. He expects a “challenging” macroeconomic backdrop in the first half of the year, Matejka wrote in a note.

European stocks have rebounded in 2023 after crashing 13% last year, as investors bet on a peak in interest rates and resilient US economic growth. Still, the benchmark Stoxx Europe 600 has underperformed the S&P 500 in dollar terms, partly due to the rally in the so-called Magnificent Seven technology behemoths.

Wall Street strategists are broadly more optimistic about the path for US equities next year, with the likes of Bank of America Corp. and RBC Capital Markets predicting a record high for the S&P 500. In contrast, BofA’s European team projects a 15% drop for the Stoxx 600 by mid-2024, while Barclays Plc expects “a bumpy ride amid mediocre growth and high geopolitical uncertainty.”

Matejka’s call that this year’s rally in European stocks would peak in the first quarter proved incorrect. However, the MSCI EMU Local Index is now just 2% above his end-2023 target.

“We believe that the risk-reward for equities will start fundamentally improving once the Federal Reserve is advanced with interest rate cuts, especially if that is happening without clear consumer and labor deterioration,” Matejka wrote. “Until then, the chances of an accident, or a more pronounced economic slowdown, are likely to be elevated.”

Over at Bernstein, strategists Sarah McCarthy and Mark Diver expect sluggish earnings growth as the economy absorbs the impact of rate hikes carried out this year.

“We remain cautious amid this ‘higher for longer’ environment, and are cognizant of the fact that it takes time for the full effect of the rate hike cycle to flush through the system,” they wrote in a note on Wednesday.

Still, they see roughly 9% upside for regional stocks as they believe the asset class has already priced in a possible recession. Among sectors, the strategists favor industries that perform well during periods of sluggish growth while having attractive valuations and earnings momentum. They also recommend utilities, banks, energy, autos and household and personal goods.