Vietnam’s central bank is facing conflicting economic priorities, a top policymaker said, citing the authority’s abrupt pivot from tightening rates toward the end of last year to cutting them this year.

The State Bank of Vietnam sees challenges in managing interest rates, currency and credit policies amid a slowing domestic economy and global turbulence, its Deputy Governor Pham Thanh Ha said at a banking forum in Hanoi Wednesday.

The central bank is working to strike a balance between boosting economic recovery and controlling inflation, while ensuring rates are stable and easing downward pressure on the dong, he said.

Vietnam’s central bank, which raised its benchmark rate by 200 basis points in two moves last year, has seen its policy shift in 2023 to support lower lending rates, besides loan moratoriums and debt recast for struggling firms. Those measures followed slowing growth in the export-reliant economy that is cooling more than expected in the first quarter, and calls from the political leadership for aid to companies.

Central banks globally are taking a turn toward more dovish policy this year, with even the US Federal Reserve leaving the door open to keep rates steady. World growth forecasts have been repeatedly downgraded, including by the International Monetary Fund last month, as stresses in the financial sector add to pressures from tighter monetary policy.

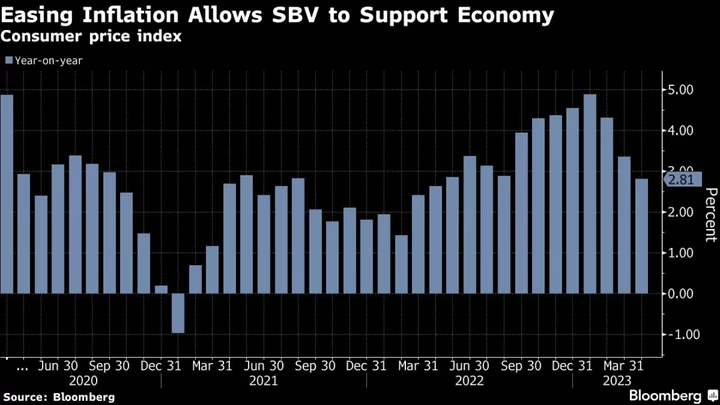

Vietnam’s inflation, at 2.81% as of April, is much less a concern now. Policymakers, though, still face the task of supporting the local currency, boosting credit demand and stimulating economic growth — which the government targets at 6.5% this year.

Vietnam’s dong faces a high risk of a sudden and sharp drop on risks stemming from the banking sector, low reserves and inflation, according to S&P Global Market Intelligence.

The central bank said it must assure the safety of the banking system while meeting the demand for loans for the economy, adding that at the same time it must also implement government solutions to support and remove difficulties for borrowers.

“These are all extremely challenging tasks,” the regulator said in an emailed statement Wednesday.

Moody’s Investors Service separately forecast that Vietnam’s foreign-exchange reserves excluding gold will rebound to $95 billion by the end of the year as the central bank rebuilds its stockpile.

“The recent appreciation of the dong, which reflects the improved external position, would give the central bank space to rebuild the FX buffers that were spent down during the US dollar’s rally last year,” said Nishad Majumdar, a sovereign analyst in Singapore. Reserves stood at $88.3 billion in January, according to the IMF.

--With assistance from Karl Lester M. Yap.