A month or so ago, Vietnam’s central bankers were rushing to ease monetary policy, sometimes within hours of the political leadership asking for an interest-rate cut. Not anymore.

After reducing rates four times this year, the State Bank of Vietnam is going slow on such actions even as Prime Minister Pham Minh Chinh has repeatedly pushed for further loosening of policies. Even a specific warning from the government that Vietnam may miss its 6.5% growth target this year hasn’t convinced the SBV to act yet.

The central bank’s current resistance to government pressure for looser monetary settings marks a departure from recent months, when political will appeared to have prevailed. Analysts attributed SBV’s approach to larger concerns surrounding currency weakness and risks arising from low deposit rates.

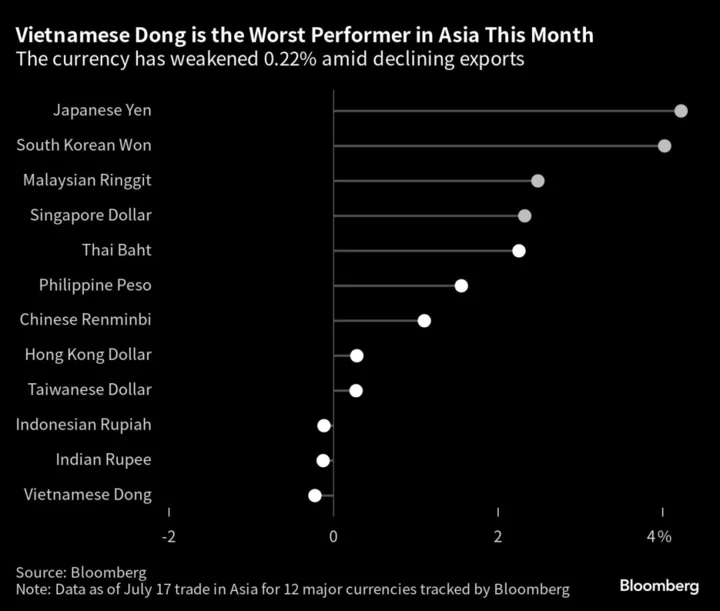

Vietnam’s dong has failed to rally alongside its Asian peers this month, losing 0.2% against the dollar, as traders weigh the risk of more rate cuts. A weaker currency exposes the nation that sourced $359 billion worth of goods last year to imported inflation. Gains to exports, which is equal to 90% of the economy, are also limited given a downturn in global demand for goods.

“More rate cuts may weigh on the dong and weaken it further,” said Hanoi-based economist Nguyen Tri Hieu, a former senior adviser to National Citizen Bank. “The SBV must be very mindful about that too.”

Lower rates are also fanning fund outflows amid a still-hawkish US Federal Reserve, with analysts seeing options for the SBV — the first across 13 major central banks in the Asia-Pacific to slash rates this year — to be limited.

“There is not much that the central bank can do right now really,” said Nguyen Quoc Hung, general secretary of Vietnam Bankers Association. With deposit rates already pretty low, any further reduction can trigger withdrawals by depositors leaving banks at risk of insufficient liquidity, he said.

Although weak global demand and domestic growth challenges are likely to weigh on Vietnam’s economic performance this year, the central bank has to also weigh risks arising from looser fiscal and monetary policies.

“State capital spending will keep the fiscal deficit above 4% this year,” according to S&P Global Ratings, which last month retained the country’s long-term foreign-currency debt rating at BB+, one level below investment grade.

“Vietnam’s dong faces a high risk of a sudden and sharp drop on concerns stemming from the banking sector, low reserves and inflation,” S&P Global Market Intelligence had warned separately.

While the room to cut rates may be limited, Deputy Governor Dao Minh Tu had said last month that requesting banks to cut their operational costs to bring down lending rates was one of the options for the central bank. The SBV will also review banks’ lending quota so that they can increase loan disbursals, Tu had said then amid calls for still lower rates.

“It needs some time to see the policy moves show its impact,” said Can Van Luc, chief economist at Bank for Investment and Development of Vietnam. “We shouldn’t all depend on the central bank’s policy rate cuts, it has to incorporate with fiscal policies.”

--With assistance from Cecilia Yap and Ditas Lopez.

(Updates with the dong performance this month in the 4th paragraph.)