Viaplay Group AB dropped more than 80% after striking a rescue deal with its lenders.

Before the deal announced Friday, the sports-and-entertainment streaming company was on the precipice after an aggressive international expansion led to mounting losses and expensive sports rights weighed on its earnings as subscriber growth plateaued.

The Swedish company plans a 3.1 billion-krona ($297 million) share issue directed at shareholders including Canal+ and PPF Group and a rights issue of about 900 million kronor to all owners. Analysts said shareholders can expect to see their holdings reduced to almost nothing under the plan.

“If we wouldn’t have done the capital injection and agreements with banks and bondholders, there would have been nothing there because the company wouldn’t have been able to meet its liabilities,” Chief Executive Officer Jorgen Madsen Lindemann said by phone.

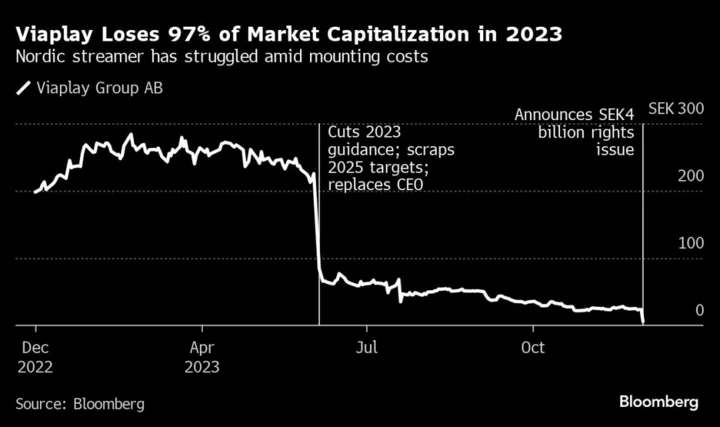

The Nordic streaming service has seen nearly its entire market capitalization vanish in 2023, with shares capping an annus horribilis by falling as much as 83% in Friday trading, erasing 1.35 billion kronor of value in less than three hours.

Both components of its recapitalization plan were priced at 1 krona per share — much lower than the closing price of 23.68 kronor the day before.

Equity analysts described the recapitalization plan as painful but necessary. Jefferies analyst Giles Thorne said in a note to clients that “without this plan, the likely outcome would have been insolvency proceedings.”

The year has been a roller coaster for the company. Viaplay saw its market capitalization peak at 22 billion kronor in March on the back of hype surrounding its large collection of highly sought-after sports broadcasting rights, such as top Premier League soccer and Formula 1 racing.

In July, the company put itself up for sale and initiated cutbacks after the costs from sports rights and acquired content continued to pile up. The expansion had taken place at “the cost of value,” the CEO said then.

The earnings report, which was postponed twice due to the funding discussions, showed a net loss of 693 million kronor for the July to September period, the fifth consecutive quarter of losses. Costs were up 14% from a year ago in the Nordics and 29% internationally.

The firm has now shed more than 30% of its workforce, which totaled just under 1,700 people at the end 2022, the CEO said.

Since July, France’s Vivendi SE, Czech investment firm PPF and Norwegian media conglomerate Schibsted ASA have all disclosed large stakes in the embattled streamer, fueling takeover speculation. Schibsted hasn’t committed to the share issue.

The plan, which also includes a 2 billion-krona writedown of existing debt obligations, as well as the amendment and extension of 14.6 billion kronor of existing bank and bond commitments, has been discussed with the company’s largest owners. It still needs sign off from an extraordinary general meeting slated for January.

“It has been important for us to have approval by relevant stakeholders and I believe we have that,” Lindemann said.