Global investors will avoid China assets for another three years as the nation keeps its interest rates low to sustain a fragile economic recovery, according to Credit Agricole CIB’s Patrick Wu.

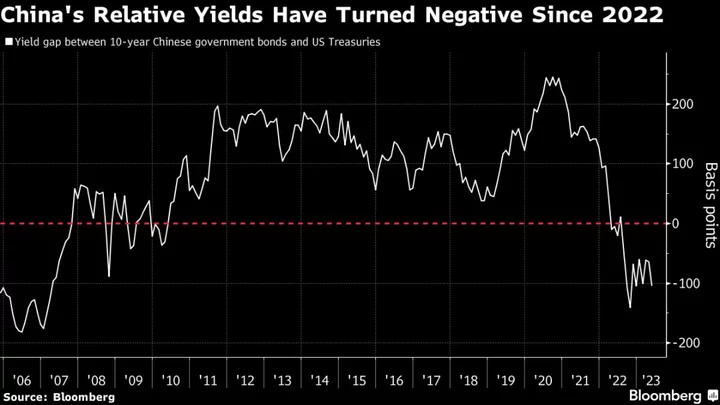

China’s yield discount to the US will remain ample as monetary policies of the world’s two largest economies continue to diverge, said Wu, who’s co-head of trading for Asia-Pacific and the Middle East. The gap, which is currently close to the widest since November, will hurt demand for onshore bonds and weigh on the yuan, he added.

China’s financial markets have been struggling in recent months, as a string of weak economic data damped traders’ hopes for a speedy recovery following Beijing’s relaxation of Covid curbs. The yuan slid to the lowest level this year, Shanghai-listed stocks are set for the worst monthly decline since October, and net foreign flows in onshore bonds turned negative in April.

“The reopening trade is over and now you can really feel the divergence,” Wu, who began his career nearly two decades ago trading offshore yuan assets, said in an interview on Monday. “Global traders won’t be going onshore to buy assets big time now.”

Most economic data China released since May — from manufacturing activities to retail sales — have missed analysts’ forecasts, prompting the likes of Goldman Sachs Group Inc. and Nomura Holdings Inc. to call for further policy easing. Meanwhile in the US, the Federal Reserve is expected to boost interest rates again by July to combat still-elevated inflation.

That means China’s 10-year yield discount to the US, which is at 104 basis points now, will remain wide or even extend further. Such a move would undermine the appeal of yuan-denominated securities relative to higher-yielding dollar assets.

The onshore yuan dropped 0.4% to 7.1166 per dollar on Wednesday, taking its decline this month to 2.7%. The currency will weaken to 7.25 in the coming months, said Wu, who started his career nearly two decades ago trading yuan assets at Standard Chartered Plc, JPMorgan Chase & Co. and Australia & New Zealand Banking Group Ltd. He serves on industry groups that helped develop trading channels such as the China-Hong Kong Swap Connect, which grants overseas investors access to onshore hedging tools.

However, the People’s Bank of China will adopt a gradual pace of policy easing to prevent a rapid depreciation in the yuan, Wu said. But a reduction in the medium-term lending facility rate is unlikely, as such a move would suggest the authorities want a weaker currency and spur more flows into bonds rather than loans.

“Right now the big trade is not to speculate on China,” Wu said. “In order to repair confidence properly, government policy needs to stay very stable and right now there’s geopolitics, there’s imbalance and there’s uncertainty on the data.”

(Updates prices and details about Wu’s career in paragraph 7.)