The US Treasury increased its planned sales of longer-term securities by slightly less than most dealers expected in its quarterly debt-issuance plan, helping spur a rally in bonds amid the possibility a wave of bigger supply will soon come to an end.

The Treasury said it will sell $112 billion of longer-term securities at its so-called quarterly refunding auctions next week, which span 3-, 10- and 30-year Treasuries, less than what many dealers expected. It also specified it now expects a single additional step up in quarterly issuance of longer-term debt — news that bolstered Treasury prices Wednesday given many dealers had warned multiple quarterly bumps were needed due to budget deficits.

Compared with August, the key difference this time was a slower pace of increases in sales of 10-year and 30-year securities, with 20-year bonds kept unchanged. That sparked a slide in long-term debt yields, with rates on 10- to 30-year maturities all down about 12 basis points. Treasuries were also supported by economic data showing signs of the economy slowing.

Prior to today’s plunge in yields, they had surged since the August announcement, with 10-year rates up more than 75 basis points since then. While Treasury Secretary Janet Yellen has rejected the idea that increased government borrowing caused the move, market participants highlight increasing concern about the widening US fiscal deficit.

“There’s a bit of relief in terms of the forward guidance from Treasury and the composition of these increases being less on the long-end,” said Zachary Griffiths, senior fixed-income strategist at CreditSights. “It’s alleviating some of the concerns that the move higher in rates over the past few months could continue unabated.”

The department is now working with a temporary windfall of more revenue this quarter than previously expected, thanks in part to an influx of deferred taxes from much of California and other states. But the US fiscal backdrop remains on a troublesome trajectory if the projections of by the Congressional Budget Office prove out, so the outlook for issuance is at risk of being revamped in future.

Many major dealers had predicted the refunding would come in at $114 billion, which would have represented the same pace of increase in longer-term debt sales as the department had unveiled at the last refunding, in August. Strategists at JPMorgan Chase & Co. were among that group. Last week, JPMorgan forecast Treasury would bump up coupon-bearing debt again in both its February and May refundings.

But the Treasury Wednesday said it now expects just a single additional step up in quarterly issuance.

“As these changes will make substantial progress towards aligning auction sizes with projected borrowing needs, Treasury anticipates that one additional quarter of increases to coupon auction sizes will likely be needed beyond the increases announced today,” the Treasury said.

Jason Williams, a strategist at Citigroup Inc., said, “Treasury about-faced, relative to the August increases, likely due to fear of increasing term premium in the long-end.” He added, “We now expect a similar auction size increases for the February refunding. This will likely be the final coupon increase of the cycle unless Treasury reverses course.”

Read more: How Rising Rates, US Debt Brought Back Term Premiums: QuickTake

In its guidance to officials, the Treasury Borrowing Advisory Committee — a panel of bond-market participants — said that there’s been some waning in appetite for US debt. TBAC noted there’s more liquidity and demand for securities maturing sooner than 10 years.

“Demand for US Treasuries may have softened among several traditional buyers,” TBAC said, highlighting the waning role of commercial and foreign central banks. “Treasury auctions continue to be consistently oversubscribed but there may be some early evidence of waning demand.”

Josh Frost, the Treasury’s assistant secretary for financial markets, played down any worries over structural demand for government debt, however.

“We are not overly reliant on any one investor or set of investors,” Frost told reporters Wednesday. There have been shifts of investor type over time, and there has been quite strong demand at the Treasury’s auctions, he said.

TBAC also said, “There is a view among market participants that the growing imbalance between supply of and demand for US Treasury debt may also have contributed to the selloff.”

The Treasury made a “smart announcement and it does denote tacit consideration of term premium and absolute rate levels,” said Russ Certo, head of rates products at Brean Capital. “Treasury gave three subtle morsels to the market, including smaller overall increases versus median forecast and sort of affirmed our view of being almost at the ‘cap’ with one more quarterly increase likely and enthusiastically guiding about buybacks” coming next quarter.

The department said its plans “will continue to depend on a variety of factors, including the evolution of the fiscal outlook” and the pace and duration of the Federal Reserve’s shrinking of its portfolio of Treasuries. The Fed is letting up to $60 billion a month of its holdings mature without replacement, forcing the government to issue more to the public.

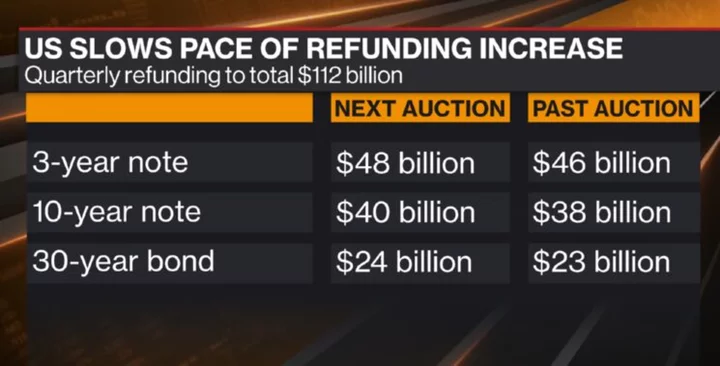

As for next week’s refunding auctions, they break down as follows:

- $48 billion of 3-year notes on Nov. 7, compared with $42 billion at the August refunding and $46 billion at the last auction in October

- $40 billion of 10-year notes on Nov. 8, compared with $38 billion last quarter

- $24 billion of 30-year bonds on Nov. 9, versus $23 billion

- The refunding will raise about $9.8 billion in new cash

The August refunding increase, to $103 billion, was the first in more than two years. Two-year notes, which are sold as new issues each month, were increased $2 billion in September and $2 billion in October as part of the guidance in August.

This time, the Treasury boosted planned issuance of 2-year, 3-year, 5-year, and 7-year securities by the same amount as in August, while 10-year and 30-year Treasury sales were bumped up by less. There is no change in planned sales of 20-year bonds.

“Treasury plans to continue with gradual nominal coupon and FRN auction size increases, but at a more moderate rate in longer-dated tenors,” the statement said. FRNs refers to floating-rate notes. “Treasury will continue to evaluate whether additional relative adjustments are appropriate when determining future changes in auction sizes.”

With regard to bills, which mature in one year or less, the Treasury said it “expects to maintain bill auction sizes at current levels into late-November.”

By early next month, the “Treasury anticipates implementing modest reductions to short-dated bill auction sizes that will likely then be maintained through mid- to late-January.” That plan comes after the department said Monday it scaled back its estimates for borrowing needed this quarter.

The share of bills in total government debt pile current is currently more than 20%, the cap that TBAC has long advised as most ideal. However, in August, TBAC indicated that exceeding the peak for a time before returning to the recommended range wouldn’t pose an issue.

Frost said there was no particular deadline under consideration for returning to that range.

“There’s no set time frame,” by when “we’d endeavor to get back to that level,” he said. “It’s mostly thought of as a useful rule of thumb.”

Read more: US Downplays 15-20% of Debt Range for T-Bills, RBC’s Gwinn Says

For its Issuance plans for Treasury Inflation-Protected Securities, or TIPS, the department said it will maintain the November 10-year maturity reopening at $15 billion and increase its new issue sale in January by $1 billion. It also said it will lift its December reopening 5-year maturity by $1 billion.

As for floating-rate notes, the Treasury plans to increase the November and December reopening auction size of the 2-year FRN by $2 billion and the January new issue auction size by $2 billion.

The Treasury also detailed increases to nominal debt of other maturities over coming months as follows:

- 2- and 5-year note auctions will each be hoisted by $3 billion per month over the next three months

- Issuance of 3-year notes will rise again by $2 billion per month

- 7-year notes go up by $1 billion per month over the next three months

- No change for the new and reopened 20-year bond auction sizes

- Increases both the new and reopened 10-year note auction sizes by $2 billion, starting in November

- Boosts both the new and reopened 30-year bond auction sizes by $1 billion, starting in November

Separately, with regard to the buyback program that the Treasury has previously said will be launched sometime in calendar year 2024, the department said it “continues to make significant progress” on its plans. An update on timing will be offered at the next refunding, the Treasury said.

(Adds strategists comments starting in fifth paragraph.)