The US will provide $553 million in financing for a port terminal in Sri Lanka’s capital being developed by Indian billionaire Gautam Adani, as New Delhi and Washington look to curtail China’s influence in South Asia.

The financing from International Development Finance Corp. for the deepwater West Container Terminal in Colombo is the US government agency’s largest infrastructure investment in Asia, and among its biggest globally. It will bolster Sri Lanka’s economic growth and “its regional economic integration, including with India, a key partner to both countries,” DFC said in a statement.

The US funding also signals renewed efforts to loosen Beijing’s sway over Sri Lanka after Colombo splurged on Chinese port and highway projects before its economic meltdown last year, which left it highly indebted to Beijing. India also wants to tilt the balance of power in its neighborhood.

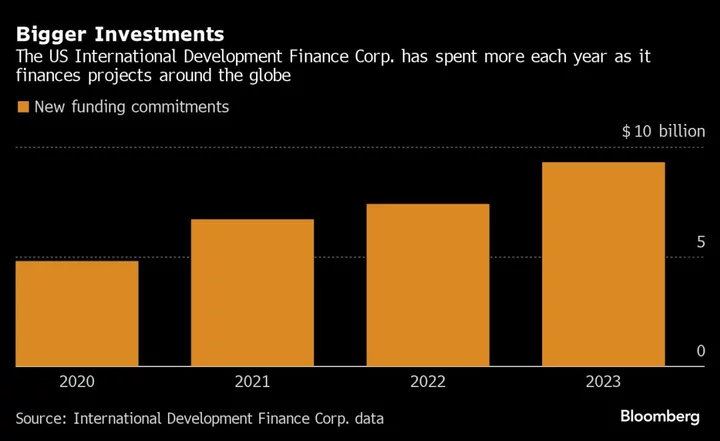

The funding is part of a global acceleration of DFC investments that totaled $9.3 billion in 2023. A US official described the Sri Lanka port financing as emblematic of the US commitment to be more engaged in development projects across the Indo-Pacific.

China had invested about $2.2 billion in the island nation as of the end of last year, its biggest foreign direct investor. US officials have publicly criticized Sri Lanka’s little-used southern Hambantota port as unsustainable and part of what it calls China’s “debt-trap diplomacy.”

DFC said it will be working with sponsors John Keells Holdings Plc and Adani Ports & Special Economic Zone Ltd., relying on their “local experience and high-quality standards.”

Colombo’s port is one of the busiest in the Indian Ocean, given its proximity to the international shipping routes. Nearly half of all container ships pass through its waters. The DFC said it’s been operating at more than 90% utilization for two years and needs new capacity.

Adani Group

The US funding may serve as an endorsement for the short seller-stung Adani Group, as well as the controversial port project in which it holds a majority stake. The conglomerate has been fighting a raft of corporate fraud allegations leveled by Hindenburg Research and various media investigations, which it has repeatedly denied.

Its energy and port investments in Sri Lanka were criticized last year by some local lawmakers as opaque and closely tied to New Delhi’s interests. The Indian billionaire — a long-time supporter of Indian Prime Minister Narendra Modi, who has challenged China in past public speeches — denied these claims, saying the investments addressed Sri Lanka’s needs. The US official declined to comment specifically on the allegations, saying only that DFC deployed strict due diligence in selecting projects.

DFC, a development finance agency launched under the Trump administration, was established to aid developing nations while advancing US foreign policy goals. It struggled at first to stake out projects around the world due to the Covid-19 pandemic.

But funding has accelerated in recent years and the agency has helped Washington close the development spending gap with China’s much more higher-profile Belt and Road Initiative, according to a new report from the AidData institute at William & Mary in Virginia.

The DFC’s funding will create “greater prosperity for Sri Lanka – without adding to sovereign debt – while at the same time strengthening the position of our allies across the region,” said Scott Nathan, the DFC’s chief executive officer.

--With assistance from Anusha Ondaatjie.