The US economy is holding up but losing steam.

While an advance in retail sales last month exceeded nearly every estimate, the report also showed consumer demand has moderated from the past year. Separate data Thursday showed factory production remained sluggish and applications for unemployment benefits held at the highest level since late 2021.

The figures suggest the economy, slowly but surely, is feeling more of the weight from the Federal Reserve’s barrage of interest-rate hikes. Officials on Wednesday decided to hold steady to assess the impact of policy so far, and based on Thursday’s data, that may in fact prove “prudent” as Chair Jerome Powell said.

The Thursday flurry of economic reports validated the Fed’s approach of changing the pace of its policy tightening. While inflation is still far above the central bank’s target, it’s slowed markedly over the past year.

“All this speaks to the resilience of the US economy. Things are slowing, obviously that’s very clear, but they’re not slamming on the brakes right now,” said Jennifer Lee, senior economist at BMO Capital Markets.

Robust hiring and decent wage growth have underpinned consumer spending, which may bolster the case that the Fed can succeed in taming price pressures without spurring a recession.

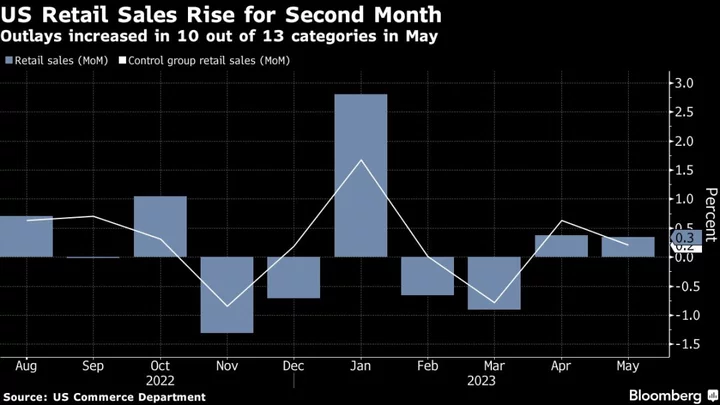

The value of retail purchases climbed 0.3% after a 0.4% gain in April. Sales in 10 out of 13 categories advanced last month, in part reflecting an unexpected pickup in purchases as auto dealers.

At the same time, so-called control group sales — which are used to calculate gross domestics product and exclude food services, auto dealers, building materials stores and gasoline stations — cooled from a month earlier.

The 0.2% gain followed a stronger 0.6% April advance, indicating “household spending will remain positive but will decelerate in the second quarter,” Rubeela Farooqi, chief US economist at High Frequency Economics, said in a note.

Manufacturing, which is more sensitive to higher interest rates, has been slowing more notably. Factory output barely rose in May, according to Fed data, suggesting manufacturers are growing cautious in the face of tepid global demand and equipment spending.

What Bloomberg Economics Says...

“Manufacturing production increased 0.1%, though the downward revision of April’s figure to 0.9% growth from 1.0% takes nearly all the shine off of May’s upside surprise.”

— Stuart Paul, economist

To read the full note, click here

Survey results were also fairly weak. The Philadelphia Fed’s metric has contracted in all but one month over the past year. And while a gauge of New York state manufacturing activity unexpectedly surged in June, the trend has been largely consistent with a broader slowdown across the country. Both measures are extremely volatile.

While the labor market is still strong by many measures, it’s “softer than it appears” considering data on payrolls, the unemployment rate and job openings, Bloomberg Economics’ Paul said. The recent jobless claims figures support that notion, he said in a separate report.

--With assistance from Reade Pickert, Augusta Saraiva and Jordan Yadoo.