The greenback is once more proving it’s the only haven that matters.

Treasuries are cratering — and sending other bond markets down — as a looming shutdown underscores the potential that US fiscal profligacy will spur issuance. With the Federal Reserve determined to keep interest rates higher for longer, investors are finding few places to hide apart from the world’s reserve currency.

The rout in US sovereign securities is actually spurring dollar demand, by helping to drive up the interest rates that buyers of the currency can receive — and keep them elevated. Investors are facing an unprecedented third straight year of losses as the $25.5 trillion Treasuries market is wracked by liquidity concerns, ever-tighter Fed policy, increased US government issuance, and the volatility created as investors get forced out of large futures bets.

“The US dollar is a high yielding, high growth, safe haven — an unusual and powerful combination,” said Andrew Ticehurst, a rates strategist at Nomura Inc. in Sydney. “We expect USD strength to continue, driven by growth divergences, higher rates and potential further risk-off moves ahead.”

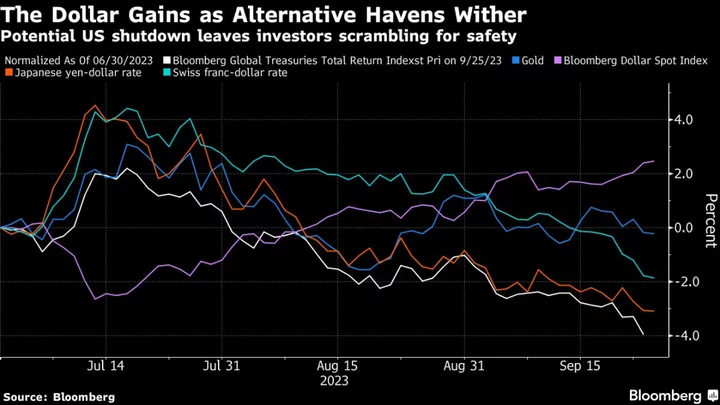

The Bloomberg Dollar Spot Index extended gains in Asia on Tuesday, and is up more than 2% in September, while alternative safety plays have mostly produced losses.

Global government bonds are tumbling toward their worst month in a year, while the Japanese yen and Swiss franc are off more than 2%. Gold is also sliding. Bitcoin has managed modest gains, though it’s still down 14% this quarter.

Yields climbed to fresh multiyear highs on Tuesday, with the 10-year benchmark rising to 4.56%. That extended a surge that came on Monday even after Moody’s Investors Service, the only remaining major credit grader to assign the US a top rating, signaled its confidence is wavering ahead of a potential shutdown.

The yen is heading for its third straight annual loss of more than 10%, as the Bank of Japan clings to extremely easy monetary policy during a wave of global tightening. Governor Kazuo Ueda this month doubled down on his dovish stance, disappointing yen bulls who had hoped he would signal a move toward ending negative interest rates.

A Bloomberg index of global government bonds is on track for its worst month in a year, with a 2.9% drop.

(Updates market levels)