Fitch Ratings said it may downgrade US credit ratings to reflect the worsening political partisanship that’s preventing a deal to solve the nation’s debt ceiling crisis.

“The Rating Watch Negative reflects increased political partisanship that is hindering reaching a resolution to raise or suspend the debt limit despite the fast-approaching X date,” the ratings agency said in a statement.

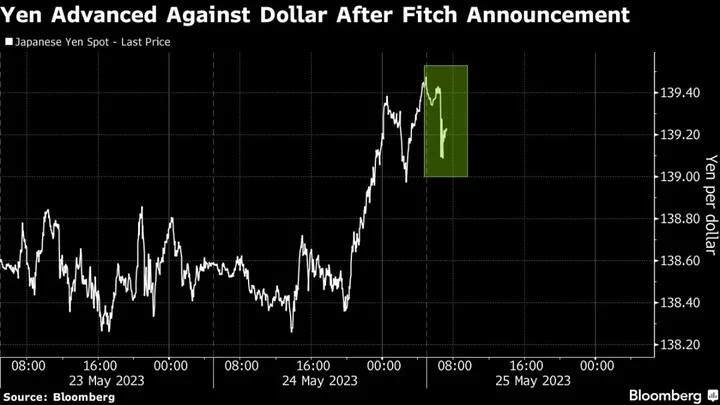

The traditional haven yen spiked as traders reacted to the news before paring gains. Treasury futures saw a modest dip.

Economists project a US default could trigger a recession, with widespread job losses and a surge in borrowing costs. Still, it’s not unusual for Congress to strike budget deals at the last minute when the pressure becomes great enough to force negotiators to make painful choices.

“We believe risks have risen that the debt limit will not be raised or suspended before the X-date and consequently that the government could begin to miss payments on some of its obligations,” according to the statement.

Fitch said it still expected a resolution to the debt limit before the so-called X-date, at which the government runs out of cash.

McCarthy Says GOP and White House ‘Have Time’ to Reach Debt Deal

House Speaker Kevin McCarthy expressed optimism Wednesday that White House and GOP negotiators would reach a deal in time to avert a potentially catastrophic US default.

The California Republican’s comments came after a four-hour meeting between his and President Joe Biden’s hand-picked negotiators, fueling optimism Congress will act before June 1, the date by which Treasury Secretary Janet Yellen has warned the US could run out of money to pay its bills.

Debt-Ceiling Anxiety Tracker: T-Bill Yields Top 7%, Fear Spreads

“I still think we have time to get an agreement, and get it done,” McCarthy said after the meeting concluded.

In 2011, S&P Global Ratings drew fire for downgrading the US from AAA after a similar brush with default. It has retained a stable outlook on the rating during the latest fracas, anticipating a deal will be struck.

Moody’s Investors Service’s William Foster, a senior credit officer, said in an interview on Wednesday that he was “hearing the right things out of Washington,” and his firm has kept the US’s top rating intact through the fitful negotiations since.

--With assistance from Margaret Collins and Michael Mackenzie.

(Updates with detail on other rating companies views.)