UK retail sales rebounded in August as the return of more settled weather brought consumers back into the shops.

The volume of goods sold in stores and online rose 0.4% in August, the Office for National Statistics said Friday. That partially recovered from a revised 1.1% drop in July, when cool and rainy conditions reduced activity. Economists had expected a gain of 0.5% in the latest month.

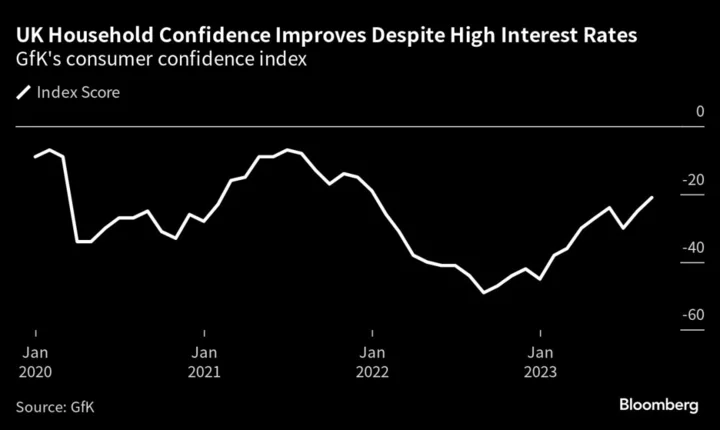

The figures come after a separate survey Friday showed consumer confidence rose to its highest level since January last year. Together, the data suggests households are holding up reasonably well in the face of an historic run of interest-rate increases.

“Retail recovered a little from the large fall seen in July, driven by a partial bounce back in food and a strong month for clothing, though sales overall remain subdued,” said Heather Bovill, senior statistician at the ONS. “These were partially offset by internet sales, which dropped slightly as some people returned to shopping in person following a very wet July. Fuel sales also fell, with increased prices hitting demand.”

What Bloomberg Economics Says ...

“UK retail sales data for August indicates a recovery is underway, supported by an easing of the cost-of-living crunch on household finances. Wage growth has been stronger than anticipated, while inflation is decelerating. And signs interest rates have peaked will lead mortgage rates to dip after surging in the summer. Interest rates, though, remain elevated, and the full impact of higher borrowing costs is yet feed through the economy. As such, we expect the rebound in retail sales to be limited.”

—Niraj Shah, Bloomberg Economics. Click for the REACT.

Food stores bounced back from soggy sales in July, with volumes rising 1.2%. A recovery in clothing retailers helped non-store sales climb 0.6% even as the cost-of-living crisis suppresses spending.

The surge in prices over the last 18 months means consumers are paying more to buy fewer goods for their money. The value of sales in August was 17% above pre-pandemic levels in February 2020, while the volume of those sales 1.5% below.

Wage growth is starting to outstrip inflation, bringing relief to family finances after the worst cost-of-living crunch in decades.

Consumers received a further boost yesterday when the Bank of England maintained rates for the first time in almost two years after a surprise slowdown in the rate at which prices are rising.

Next Plc, a a bellwether for the health of the retail sector, yesterday raised its profit guidance for the third time in recent months. Other retailers are also faring better, with Marks & Spencer Group Plc raising its outlook in August to predict profit growth this fiscal year.

“The mild start to the darker months and the fall in the energy price cap could see sales buoyed as consumers save on power costs that might have been brought about by a cold spell,” said Aled Patchett, head of retail and consumer goods at Lloyds Bank. “With food price inflation easing somewhat, it should help lead to a slight recovery in shopper confidence.”

While the pressure on living standards is expected to ease further, households are struggling with a number of headwinds. Unemployment is rising and millions of homeowners are braced for a sharp increase in their mortgage payments as cheap-fixed deals expire. Some economists think the UK is heading for a mild recession.

Retail sales appear on course to fall over the third quarter as a whole, thanks to the sharp fall in July. A 1.4% gain in September will be needed simply to maintain sales at the level of the second quarter.

“While the worst of the falls in real household disposable incomes are behind us, the full drag on activity from higher interest rates has yet to be felt,” said Alex Kerr at Capital Economics. “As such, we still think that real consumer spending will decline by 0.5% from its peak to its trough over the coming quarters.”

--With assistance from Eamon Akil Farhat.

(Updates with detail and comment from the report.)