Highly-anticipated reforms of UK pensions could channel billions of pounds into fast-growing companies and boost investments in riskier assets, the Financial Times reported.

Chancellor of the Exchequer Jeremy Hunt will use his annual Mansion House speech next month to unveil regulatory changes to encourage pension funds to invest in high-growth British assets, including early-stage companies and equities and infrastructure focused on green initiatives, the FT said, citing unidentified sources. That would mirror the approach taken by large Canadian and Australian retirement asset managers.

Hunt is “closely examining” a proposal by consultants the Tony Blair Institute to pool tens of thousands of public and private sector pension programs into “superfunds” that would invest in UK startups, infrastructure and other companies, the FT said. That would allow a diversification of the range of investments held by managers of about £3 trillion ($3.8 trillion) in assets, with British funds seen as too risk averse compared to international peers.

Managers of UK defined benefit funds, which promise a secure pension based on salary and length of service, have moved away from domestic stocks. Since 2008, the proportion of UK equities held by such managers has fallen from about 50% to less than 10%. Over the same period, holdings of bonds have climbed to more than 70% from about a third, the FT said.

Hunt’s proposals are aimed at boosting returns for British pensioners while also securing funding for new businesses to scale up and in turn boost economic growth.

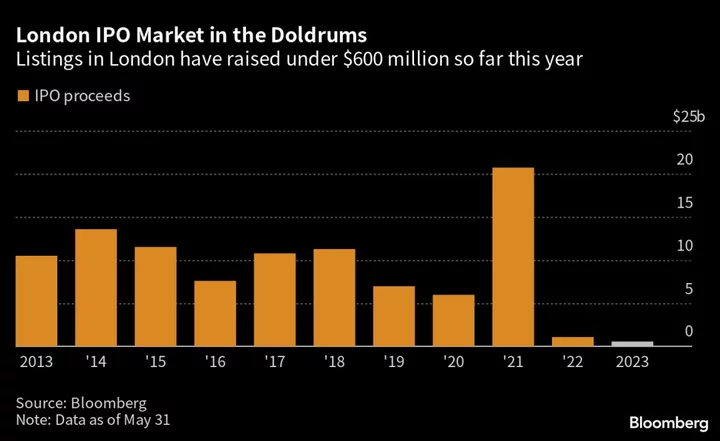

The Chancellor has been under pressure to address the loss of attractiveness of the UK stock market, with an increasing number of companies moving their primary listings to other countries, including the US. The domestic market for initial public offerings has also been in the doldrums, with just under $600 million raised so far this year, according to data compiled by Bloomberg.

Cambridge-based chipmaker Arm Ltd, a crown jewel in Britain’s technology industry, has decided against a UK IPO in favor of the US. Firms including CRH Plc, one of Europe’s largest building materials producers, also see capital markets across the Atlantic as more attractive.

Pension reforms could help boost demand for UK assets, equities in particular, which have trailed European and global peers for years. UK stock market volumes have been trending down since 2017, and valuations of UK stocks have been falling to a record 40% discount to global developed peers, based on forward price-to-earnings ratios.

Read more: Why UK’s Once-Vibrant Stock Market Is In the Doldrums: QuickTake

Cheaper valuations and the weakness of the currency are making UK companies more attractive to foreign buyers, and concerns have been mounting about British companies falling into foreign ownership, in part due to a lack of investment by UK pension funds.

The total capitalization of London-listed equities fell from a high of $4.3 trillion in 2007 to about $3 trillion in June 2023, according to data compiled by Bloomberg. Over the same period, the value of US stocks more than doubled to $46 trillion. Paris overtook London as Europe’s largest stock market in 2022, and London is now the seventh-biggest equity market globally, also trailing the US, China, Japan, Hong Kong and India.

The final version of the pension reform will be set out in the Chancellor’s Autumn Statement later this year.