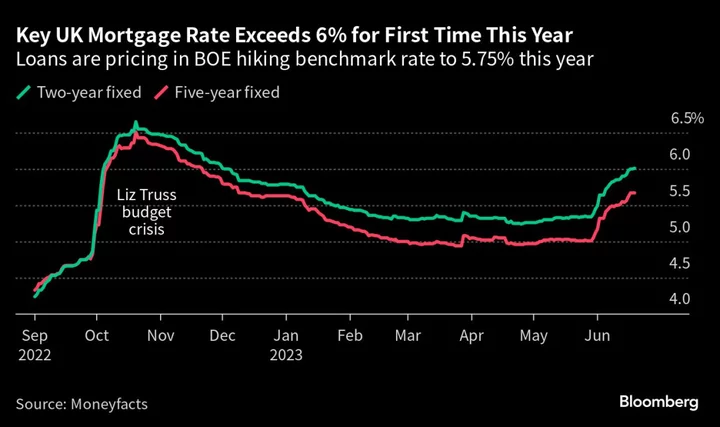

The squeeze on finances for thousands of British homeowners is set to intensify after a key rate on mortgage borrowing climbed to its highest level since December.

The average two-year fixed-rate home loan jumped to 6.01% on Monday, edging closer to the 14-year highs reached at the end of 2022, according to Moneyfacts Group Plc. The average five-year fixed-rate deal climbed to 5.67% after breaching 5.5% for the first time since January last week.

Read more: Surging Mortgage Costs Push UK Housing Market to Breaking Point

The UK housing market is under pressure from a triple whammy of pricey borrowing, economic uncertainty and the worst cost-of-living crisis in a generation. That’s prompted some of the biggest lenders — including HSBC Holdings Plc and Banco Santander SA — to temporarily pull products from the market this month as bond yields rise to levels last seen in 2008.

All eyes now turn to two crucial moments this week, when inflation figures and a Bank of England policy decision could combine to set the scene for larger house price declines. That’s because faster-than-expected inflation growth would heighten speculation that the BOE will have to tighten monetary policy even more than anticipated.