UK Chancellor Jeremy Hunt is likely to take an ax to the welfare bill to find savings for tax cuts in next week’s Autumn Statement because room for maneuver against his fiscal rules will be “wafer thin,” according to an analysis by Bloomberg Economics.

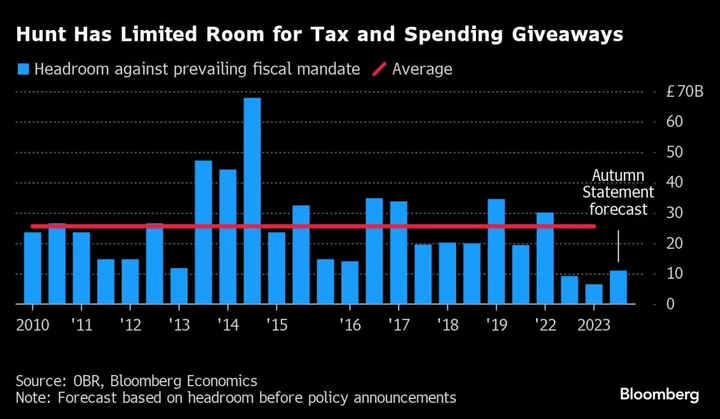

Dan Hanson, senior UK economist at Bloomberg Economics, said Hunt will have just £11 billion ($13.7 billion) to spare against his key fiscal rule, which requires debt to fall as a share of gross domestic product in the fifth year of the forecast.

If the spending watchdog, the Office for Budget Responsibility, cuts its trend growth forecast by just a quarter of a percent, Hunt’s headroom will be more than wiped out. That would force him to find £9 billion to fill the hole.

“We’re not expecting the Autumn Statement to be game-changing for the economic outlook — the fiscal arithmetic simply doesn’t allow for it,” Hanson said. Bloomberg Economics’ estimate of headroom is roughly in line with the £13 billion projected by the Resolution Foundation.

Bloomberg has reported that the government is considering cuts to welfare totaling as much as £5 billion to raise some money for giveaways, potentially halving the 40% rate of inheritance tax and lowering stamp duty.

Hunt also wants to extend full expensing, a 100% tax relief on capital investment which saves companies 25p in every £1 spent. That costs £10 billion initially, but the bill declines over time. He is also expected to scrap a planned uprating in fuel duty at a cost of £3 billion.

Last week Hunt said, “When it comes to personal tax cuts, there are no short cuts. You have to control the growth in public spending. You need to reform the welfare system.” He added that it would be “an autumn statement for growth.”

Hanson cautioned the Chancellor against trying to fiddle the numbers to allow for tax cuts by penciling in more unspecified departmental spending reductions at the end of the forecast.

“We would warn that further slashing an area of spending that has been one of the main victims of austerity and is now under significant pressure from high inflation, is not credible,” he said.