British lenders will likely have to pass on all of the Bank of England’s record rate hikes to some savers, a JPMorgan Chase & Co. analyst predicted as he warned of intensifying risks to profits in the sector.

“With increased political pressure, we believe that deposit pass-through is likely to be closer to 100% on interest-bearing time deposits, with negative implications for deposit migration and loan books,” Raul Sinha wrote in a note to clients. Time deposits are savings that can’t be withdrawn without penalty for a fixed period.

Lenders in Britain and elsewhere are expected to compete for deposits by offering savers higher rates of interest. The opposition Labour party’s Lisa Nandy at the weekend called for measures to be introduced to force banks to pass more of the rate hikes on to savers.

Read: BOE Steps Up Inflation Fight With Surprise Rate Hike to 5%

JPMorgan’s Sinha downgraded Lloyds Banking Group Plc to underweight from neutral — the first time JPM has recommended selling the stock in more than a decade, according to data compiled by Bloomberg. He cut the stock to neutral from overweight on Nov. 1, since when it has risen 0.7%.

Net interest income is nearing a peak, Sinha said, cutting his consensus earnings-per-share forecasts for the sector by 3%-9% for fiscal 2024-25. The probability of a hard landing for the UK economy has increased due to restrictive BOE policy, he added.

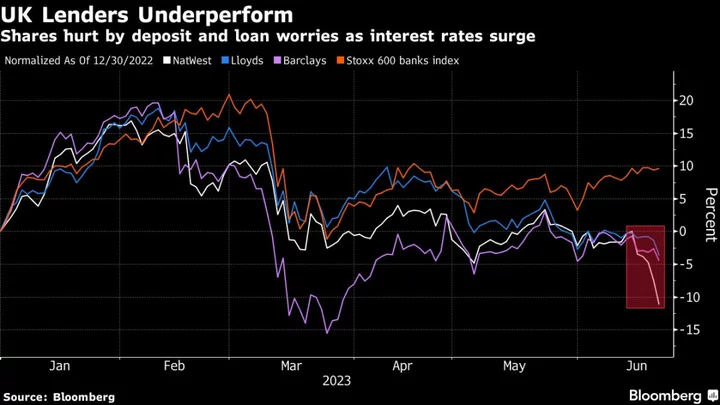

“We remain cautious and continue to see domestic UK banks underperforming the broader sector,” he said, keeping NatWest Group Plc at neutral and Barclays Plc at overweight.

Lloyds shares fell as much as 2.5% in early trading amid broader weakness in European bank stocks. Barclays fell 2.5% and NatWest was down 1.5%.

--With assistance from James Cone.