UK lenders are removing mortgage deals from the market again as fresh increases in rates make loans more costly.

The number of home loan products available in the UK fell more than 3% over the holiday weekend to 5,012 on Tuesday, according to data company Moneyfacts Group Plc. Saturday saw the biggest one-day decline so far this year, with the number of products now at its lowest since March.

“Over the past few days, we have seen a few lenders withdraw selected fixed products, with some pulling out of the market,” said Rachel Springall, a finance expert at Moneyfacts. “Product choice has started to fall, and as may be expected, average fixed mortgage rates are on the rise.”

It’s the latest setback for under-pressure homeowners as banks adapt to the growing cost of providing loans.

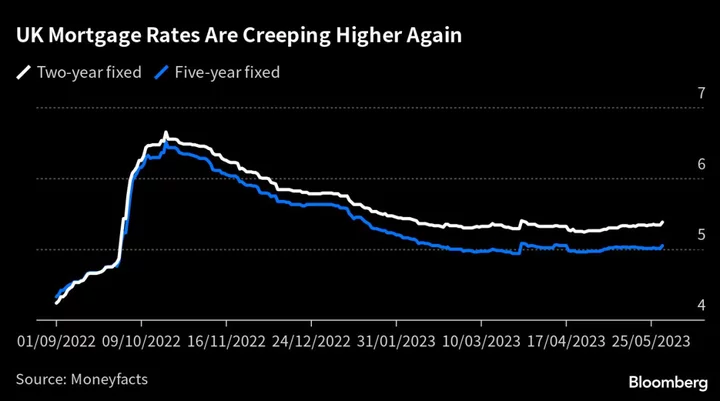

The average two-year fixed-rate mortgage on a home rose to 5.38% on Tuesday, the highest since March, after a high inflation reading last week prompted money markets to bet that Bank of England interest rates will peak as high as 5.5%. Swap rates — effectively the price of borrowing from other banks to fund mortgages — had already risen by almost a percentage point in the past month, even before last week’s inflation data.

Still, loans remain cheaper and more plentiful than last October, when an ill-fated government budget fueled a market meltdown.

While the UK inflation rate fell back into single digits in April, it continues to outpace wage growth. Potential buyers are finding it even harder to afford the cost of repaying a home loan, contributing to net mortgage lending falling to virtually zero in March, according to BOE data.

“This volatility is down to the concerns surrounding future interest rate hikes,” Moneyfacts’ Springall said. That’s why “lenders are reassessing their propositions,” she added.