Bank of Japan Governor Kazuo Ueda suggested it’s possible to start normalizing monetary policy if the BOJ becomes confident inflation will pick up next year.

For now, underlying inflation remains below 2%, and the BOJ’s outlook is for price increases to slow toward the end of the year, Ueda said Wednesday. He didn’t specify whether he was talking about the fiscal year that ends next March.

“From there on, we are forecasting some increase in the rate of inflation into ’24 — but, we are less confident about the second part,” he said at the European Central Bank’s annual retreat in the Portuguese hilltop resort of Sintra. “If we become reasonably sure that the second part is going to happen, that could be a good reason for a policy change.”

He noted that the BOJ’s most recent set of forecasts penciled in 2% inflation for the 2024 fiscal year. While the consumer price index has been rising more than 3% lately — “which is well above the 2% inflation target — we think underlying inflation is still a bit lower than 2%,” he said. “That’s why we are keeping policy unchanged at the moment.”

The comments were largely in line with the consensus view that the BOJ will seek more evidence before considering a policy shift. Still, the remarks prompted some economists who saw adjustment taking place by July to consider lowering their conviction.

Speaking alongside counterparts from the US, the euro zone and the UK, the recently appointed BOJ chief highlighted the continuing policy divergence from his global peers — who cited the strength of underlying inflation as a reason to keep tightening.

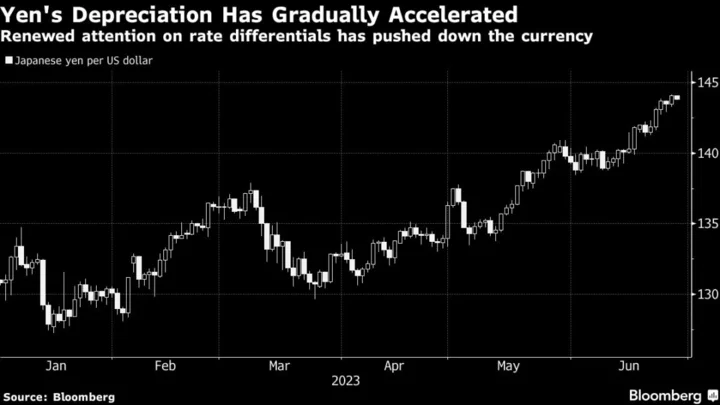

The yen weakened to a fresh seven-month low this week, prompting warnings from government officials, and forcing Ueda to tread a delicate line in his journey toward attaining the BOJ’s stable inflation target.

“The yen is being influenced by many factors other than our monetary policy, including the policies of these three banks,” the Japanese governor said, when asked about the currency. “So we will see. We will monitor the situation very closely.”

Economists noted Ueda’s playing down of recent price data showing inflation still well above 2%, a factor that suggests changes to the central bank’s stimulus, including its yield curve control program are not imminent.

“Ueda seems to be distancing himself from current inflation figures and showing he is forward looking,” said Yasunari Ueno, chief market economist at Mizuho Securities, one among a third of economists who expected the BOJ to tweak policy by July when surveyed in June. “The likelihood of him having enough confidence by the July meeting is less than 50%.”

Morgan Stanley strategists including Martin Tobias flagged the importance of the remark on needing more confidence about the 2024 inflation forecast.

“This could shift a YCC adjustment out to our economists’ risk scenario, the October BOJ meeting,” they wrote in a note.

In his first major public panel discussion overseas with his counterparts, Ueda surprised observers by cracking jokes. He suggested that Japan’s plan to unveil a new set of banknotes next year could boost public confidence in the BOJ. The panel ended with the governor quipping that he hadn’t realized he had to attend so many press conferences and travel so much as BOJ chief.

Ueda has repeatedly stressed the high cost of premature tightening as green shoots finally emerge to generate sustainable inflation. With his more dovish than expected stance, the governor has made BOJ watchers push back their policy forecast after taking the central bank’s helm in April.

Asked about the outlook for consumer prices, Ueda reiterated the BOJ’s most recent forecasts. He observed that consumers’ views are changing, but not yet enough.

“We are seeing that inflation expectations are rising, but as I said not to the extent that we are full in the 2% inflation expectations equilibrium,” he said. Ueda also said the BOJ’s outlook is for the inflation path “to go down for a while, toward the end of this year, on declines in import prices” that spill over to domestic prices.

The central bank is widely expected to raise its inflation projection at its next meeting on July 27-28. The third of surveyed economists who forecasted a policy change in July expect the bank to cite a brighter price outlook as a reason behind that shift.

--With assistance from Zoe Schneeweiss and Yumi Teso.

(Adds economist comments)