The Bank of Japan continued to defy global central bank trends by sticking with stimulus as it waits for signs of more sustainable inflation while its peers signal the need to raise interest rates further to rein in prices.

Governor Kazuo Ueda and his fellow board members left their negative interest rate and yield curve control program unchanged at the end of a two-day gathering and maintained their view that inflation will slow over the coming months, according to a statement Friday.

The yen declined after the decision, falling 0.3% to around 140.70 per dollar before paring losses. It had hit a seven-month low of 141.50 on Thursday. Japan’s benchmark government bond edged higher when it reopened after the daily lunch break.

The outcome of the meeting was in line with the views of 44 out of 47 economists surveyed by Bloomberg.

The decision underlines the BOJ’s outlier status among global peers including the Federal Reserve and the European Central Bank. A renewed focus on rate differentials during a busy week of central bank decisions helped send the yen to a seven-month low against the dollar and a 15-year nadir against the euro Thursday.

“The decision should not have been a surprise to anyone other than die-hard hawks,” said John Vail, chief global strategist at Nikko Asset Management. “Anyone who shorts the yen versus the dollar must realize that the authorities will likely intervene with little warning if it gets much weaker.”

Last autumn Japan stepped into currency markets to prop up the yen when it approached the 146 and 152 levels against the dollar.

The Fed skipped a rate hike earlier this week, while the ECB raised its main rate again Thursday. Both hinted at the likelihood of more hikes to come as they continue to battle against inflation, signals that could keep pressure on the yen.

By contrast, Ueda is sticking to his view that the cost of prematurely tightening policy could do more to damage Japan’s nascent inflation trend after years of work to get prices rising as part of a growth strategy. The BOJ’s dogged defense of its stimulus and in particular its cap on government debt yields have served as an anchor for global yields.

Still, speculation rumbles on that the BOJ may choose its next meeting in July to tweak its control of yields, a move that could trigger renewed turbulence in global markets as seen after an adjustment in December.

“Ueda wants to be logical and that likely means he wants to make a policy change when the BOJ revises up its inflation or economic outlook,” said Masamichi Adachi, chief Japan economist at UBS Securities and a former BOJ official. Adachi holds the view that the BOJ will move in July.

“The BOJ can’t really say they are going to adjust the YCC ahead of time, so every BOJ meeting is live now just like the Fed’s,” he said.

In the run up to the gathering, Ueda faced little market pressure to change policy. Japan’s stocks hit a 33-year high, bond yields stayed below BOJ’s defense line and the yen showed no sign of overshooting.

The possibility of Prime Minister Fumio Kishida calling an early election was also seen by some economists as a reason for the BOJ to avoid any action that could ruffle markets at Friday’s meeting. The premier indicated Thursday that he wouldn’t dissolve parliament for an election in the current session due to end June 21.

Read More: Japan Premier Kishida Cools Speculation for Early Election

“I was expecting Kishida to call an election now,” said Mari Iwashita, chief market economist at Daiwa Securities Co. “If he decides to go for one in the fall, that would likely take place after he extends the government’s price-relief measures. That’s a factor that would weigh on inflation.”

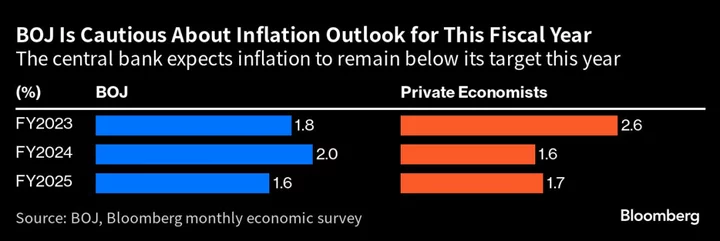

For now, though, economists are flagging that the central bank’s inflation forecast for this fiscal year is too low and needs bumping up when the BOJ releases its quarterly projections in July. That could provide a reason for policy tweaks then.

Goldman Sachs this week raised its price outlook to 2.8% for this fiscal year, widening a gap with BOJ’s 1.8% estimate. Unaffected by government utility measures, an underlying inflation indicator has continued to accelerate to the highest level since 1981.

In its statement on Friday, the BOJ stuck to its view that inflation will slow toward the middle of the current fiscal year ending in March.

“There was no indication in today’s statement that the BOJ will move to revise its policy at its July meeting,” said Naomi Muguruma, chief fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities. “If the BOJ did hint at some move, the market would try to factor it in, so as Governor Ueda said, they will probably not be able to say anything about revising YCC until the last minute.”

Ueda will hold a media briefing likely at 3:30 p.m. to elaborate on his thinking behind today’s action.

--With assistance from David Finnerty, Marcus Wong and Erica Yokoyama.

(Adds comments from economists)