Inside the walls of the Bank of Japan, there’s a sense of relief as new boss Kazuo Ueda inches toward policy normalization with the minimum of fuss — an approach that couldn’t be more different from his predecessor’s dramatic debut.

Back in 2013, Haruhiko Kuroda unleashed “shock and awe” policies to shake a lethargic economy out of deflation. Now, with inflation having racked up 16 months above the central bank’s 2% target, Ueda has done more than many insiders thought possible to prepare the ground for exiting the world’s boldest monetary experiment.

BOJ officials view Ueda’s scholarly communication style as the most obvious difference from the previous governor, according to people familiar with the matter. Where Kuroda doggedly stuck to script, using set phrases that reiterated the need for stimulus, Ueda tends to give thorough and sometimes divergent answers to questions fired at him by journalists or lawmakers.

The first academic to become BOJ governor also has no qualms about considering different scenarios in public — a trait that makes some at the bank nervous, the people said. But that public musing has also allowed the septuagenarian economist to float ideas and road test the impact on markets.

The central bank isn’t expected to take any major step at the end of its meeting on Friday, but the communications groundwork appears to be under way for the eventual scrapping of the last negative policy rate among major economies.

Many BOJ watchers interpreted his recent comments to the Yomiuri newspaper as part of that process. In the interview, he said it wasn’t out of the question for the central bank to have sufficient information to judge the sustainability of wage growth by the end of the year. That’s a condition for policy change, including the possibility of raising interest rates.

BOJ officials viewed the comments as offering no new signal on policy, people familiar with the matter told Bloomberg.

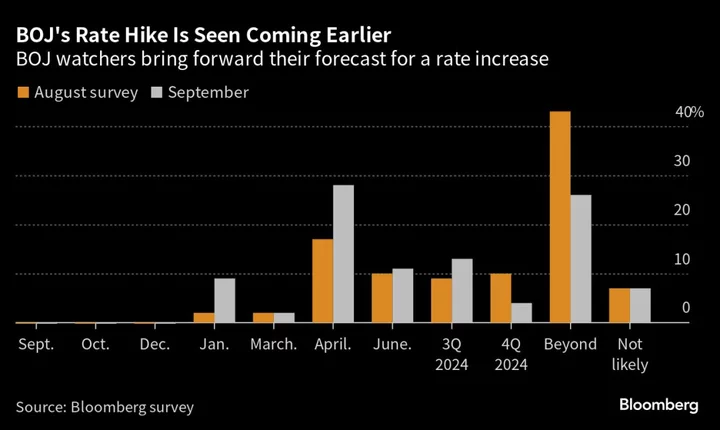

Regardless of whether Ueda was intentionally hinting at what was in the pipeline, the remarks prompted many economists to bring their policy change forecasts forward. Half of those surveyed by Bloomberg now see the central bank ending subzero rates in the first half of next year.

The other takeaways from Ueda’s opening months at the helm are that he is much more open to change than expected and more willing to acknowledge the currency implications of policy.

Already, Ueda has ditched a promise to cut interest rates if needed and has considerably loosened the guiderails of yield curve control — the policy adopted by Kuroda in 2016 to manage rates on bonds out to 10 years. Unusually, he acknowledged that currency volatility was among the factors behind the decision.

When Ueda started as governor in early April, the yield on 10-year government debt was around 0.45%. Now it’s around 0.7%.

“The BOJ under Ueda is steadily working to pare an excessive level of stimulus to an appropriate level,” said Makoto Sakurai, a former BOJ board member who knows both Kuroda and Ueda well. “There’s already been a bit more progress than expected in shifting away from monetary easing.”

Ueda has achieved that quietly to avoid panicking investors or turning homeowners, voters and business leaders against the prime minister who picked him for the job. If he goes too slow on paring back stimulus, the yen may plunge to new lows. Go too fast and he risks toppling the economy and sparking a return of Japan’s deflationary malaise.

Investors in battered global bond markets are fretting about the loss of the last global anchor on rock-bottom yields. Markets in Australia, France and the Netherlands with an overexposure to Japanese portfolio investment could see money sucked away if rates shoot upward in Tokyo.

Debt servicing costs could spiral up too if rates rise just as Prime Minister Fumio Kishida ramps up spending on defense and childcare. Managing the developed world’s largest debt load already devours more than a quarter of Japan’s annual budget.

But if Ueda simply sticks with the status quo, he risks testing the patience of Kishida, who is having to resort to yet more measures to relieve the impact of the strongest inflation in decades while maintaining the threat of currency intervention.

What Bloomberg Economics Says...

“Ueda speaks logically and answers questions respectfully. But he has room to improve when it comes to sending a strategic message. Speculators sold the yen on his repetition of dovish comments early on. Market players also wonder about his real intentions after the surprise tweak to YCC in July and his remarks in the Yomiuri interview.”

— Taro Kimura, economist

The extent of past stimulus efforts dictate a moderate approach to scaling back. The central bank has accumulated a mountain of assets that’s 25% larger than the entire size of the world’s third-largest economy, dwarfing the respective stimulus efforts of the Federal Reserve and the European Central Bank even at their peak.

Against this backdrop, Ueda has managed to keep markets largely unruffled even as he allows 10-year yields to climb.

While Ueda has publicly said the bank must continue on an easing path for now, he has demonstrated flexibility in determining how the central bank walks along it.

The governor is showing that he is committed to the project of achieving a virtuous cycle of prices, wages and growth in Japan — as he has been since the late 1990s when he had his first stint on the BOJ board. But he is also demonstrating that he is not invested in the complex web of stimulus measures dreamed up by his predecessor.

While both Ueda and Kuroda are probably no different in their determination to achieve stable inflation, Ueda is the better, more logical communicator, according to Masamichi Adachi, chief Japan economist at UBS Securities and a former BOJ official. Ueda has also demonstrated an ability to adjust policy in line with changes in the economy, Adachi said.

“Still, the outlook for the US economy and spring wage negotiations are among the uncertainties that lie ahead,” Adachi added. “These are among the boxes he has to check before he can normalize policy.”

--With assistance from Sumio Ito.