The panel which oversees the credit-default swap market has ruled that UBS Group AG will become the reference entity for Credit Suisse Group AG’s contracts.

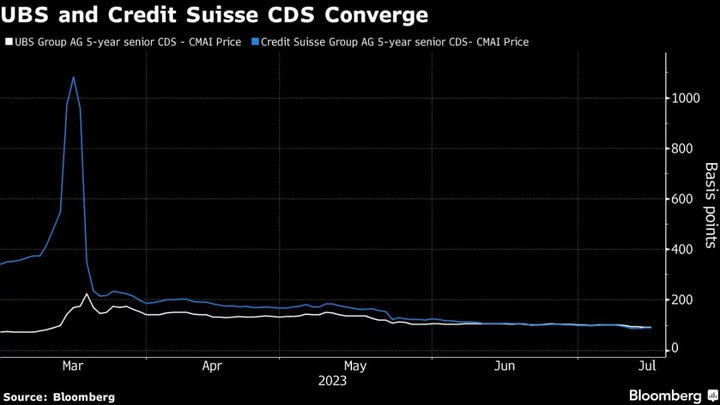

The Credit Derivatives Determinations Committees said that UBS Group is the “sole successor” to Credit Suisse Group, according to a notice on its website on Monday. Credit-default swaps tied to the debt of the two banks have been converging in recent months as investors bet on this outcome.

Credit Suisse’s five-year senior swaps contracts were indicated at 90.8 basis points as of 10:55 a.m. in London, while UBS’ equivalent swaps were indicated at 92.7 basis points, according to ICE Services data. Credit Suisse’s swaps surged to over 900 basis points as crisis hit the Swiss lender in March, before falling back after the Swiss government brokered a deal for UBS to take over its rival.

Today’s decision marks another step forward in the complex process of merging the two banks, and puts to rest any speculation that the Credit Suisse contracts could have triggered a payout. In May, the panel ruled twice against calling a credit event over Credit Suisse following the wipeout of $17 billion of additional tier 1 bonds and the UBS takeover.

The committee today pointed to UBS Group’s statement on June 12, which confirmed that the acquisition of Credit Suisse was completed, as the basis for its decision. UBS assumed Credit Suisse Group’s outstanding obligations under its outstanding debt securities at that point.

The process to select new standard reference obligations, or which UBS Group securities will replace the debt previously underlying Credit Suisse Group’s swaps, has commenced, according to the statement.

Until this is decided “it is possible that some disruption could occur,” the committee said, particularly when it comes to clearing and entering into off-setting transactions regarding contracts that originally referenced Credit Suisse Group.

The committee also urged market participants to act quickly in deciding how best to approach transactions related to swaps tied to Credit Suisse Group’s subordinated debt. A number of options were outlined.

Market participants had asked the committee the question on the successor back in June, shortly after the deal was completed, with a further question made to clarify which obligations could be deliverable at subordinated level.

Click here for a QuickTake explainer on the CDDC.

The net notional volume of Credit Suisse’s swaps outstanding amounted to $1.74 billion as of May 12, according to data from the Depository Trust & Clearing Corporation.

Eleven participants on the panel agreed that UBS becomes the reference entity for Credit Suisse’s CDS, while there were no votes against. Credit Suisse abstained under the panel’s rules from taking part in the committee.

(Updates throughout.)