Turkey’s central bank delivered a significantly smaller interest-rate increase than anticipated, as policy makers embark on what they said will be a gradual transition from an era of ultra-cheap money.

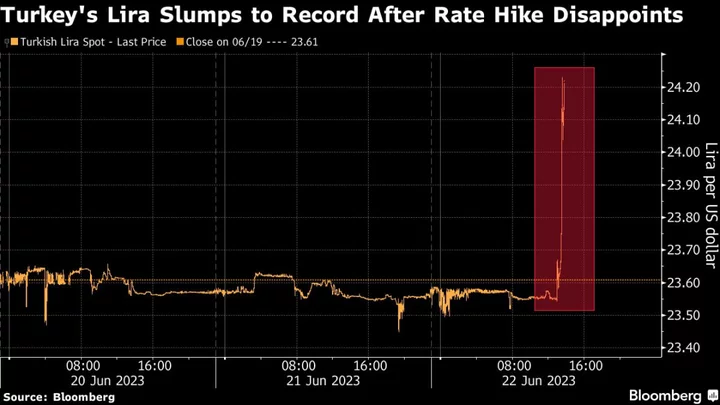

The Turkish lira slumped as much as 4.3% after the first rate-setting meeting since Governor Hafize Gaye Erkan took over this month. The Monetary Policy Committee increased its policy rate of one-week repo to 15% from 8.5%. 8.5%.

The lira was trading 4.1% lower at 24.5483 per dollar at 3:49 p.m. in Istanbul, while state lenders paused interventions to support the currency. Turkey’s dollar bonds erased gains to trade lower on the day, and the cost to insure Turkish debt against default using credit-default swaps jumped 36 basis points to 529.

Benchmark stock index Borsa Istanbul 100 climbed as much as 3.7%, driven higher by exporters that stand to benefit from a weaker currency.

The rate decision was a surprise to the vast majority of economists surveyed by Bloomberg who had predicted a move to 20% or more. Goldman Sachs Group Inc. forecast a jump to 40%.

While the rate hike was sizable, investors were expecting even more from the Turkish central bank, hence the rout in Turkish assets.

The bank’s “gradualist” approach will likely result in “a learning process between markets and policymakers in the coming months,” Simon Quijano-Evans, chief economist at Gemcorp Capital Management in London said.

Still, “it is a positive signal and a step in the right direction, but more needs to be done. The market will likely be disappointed that the initial policy move from the new economic team was not more forceful and vigorous,” said Todd Schubert, Dubai-based head of fixed income research at Bank of Singapore.

Gradual Moves

The central bank pledged further tightening but cautioned that future steps would be gradual, in line with guidance from Treasury and Finance Minister Mehmet Simsek.

“Monetary tightening will be further strengthened as much as needed in a timely and gradual manner until a significant improvement in the inflation outlook is achieved,” the MPC said. “The Committee will simplify and improve the existing micro and macroprudential framework,” it said, signaling an unwinding of regulations targeting the nation’s banks.

The first rate hike in over two years is a turning point in Turkey’s departure from unconventional policies that are blamed for causing foreign investors to flee and prices to spiral out of control.

But it also vindicates those who questioned if President Recep Tayyip Erdogan — a self-described “enemy” of high interest rates who’s espoused the benefit of loose monetary policy for years — would give Erkan free rein.

Marek Drimal, lead strategist at Societe Generale in London, who accurately forecast the rate hike to 15%, viewed the decision as “positive.”

“The central bank correctly pointed out the problem of strong demand and elevated underlying inflation — and also pledged to deliver more tightening,” he said. “We expect 500 basis points of rate hikes at each the July and August meetings, bringing the policy rate to 25%.”

Inflation has slowed since last year, but is still as high as 40%. That’s put pressure on the lira, which has lost more than 60% of its value in the past two years in spite of state intervention to prop it up.

What Bloomberg Economics Says...

“We expect this to be the first step in a series of credibility-building policy changes. Based on our long-standing view, we think the central bank’s next move will include an unwinding of its complex set of rules and regulations alongside a gradual tightening cycle, prioritizing those inhibiting the transmission mechanism.”

— Selva Bahar Baziki, economist. Click here to read more.

Policy Reboot

Erdogan set the gears in motion toward a policy reset soon after emerging victorious from presidential elections last month.

In overhauling his economic team, Erdogan brought back ex-Merrill Lynch strategist Simsek as finance minister and installed Erkan at the helm of the central bank.

Turkey’s first female central bank governor worked for nearly a decade at Goldman Sachs before spending almost eight years at failed US regional lender First Republic Bank.

Though the latest move was a surprise to much of the market, authorities tried to manage expectations ahead of the meeting.

A senior Turkish economic official, who asked not to be named because of the sensitivity of the issue, cautioned earlier that the jumbo rate hikes that were being priced in by the market may not materialize on Thursday.

Simsek also told the nation’s top business and banking executives last week that he wanted to tread carefully to avoid unwanted side-effects, suggesting he’s wary of raising the cost of money too sharply.

Predictable fiscal and monetary policies, backed by a comitment to principles of free markets will attract capital flows into Turkey’s economy, Simsek said in a Twitter post after the central bank decision.

Erdogan, who’s on his fifth central bank governor in four years, has maintained that lowering the cost of money will eventually result in slower and more stable inflation, a belief that goes against the core premise of major central banks around the world.

Earlier this month, the president appeared to give his new economy team the flexibility to act, saying he had “accepted” the measures they would take. In 2020, he allowed a brief return to conventional monetary policies, but ended up sacking then-Governor Naci Agbal for increasing rates too aggressively.

--With assistance from Joel Rinneby.

(Updates with market moves, analyst comments from third paragraph.)