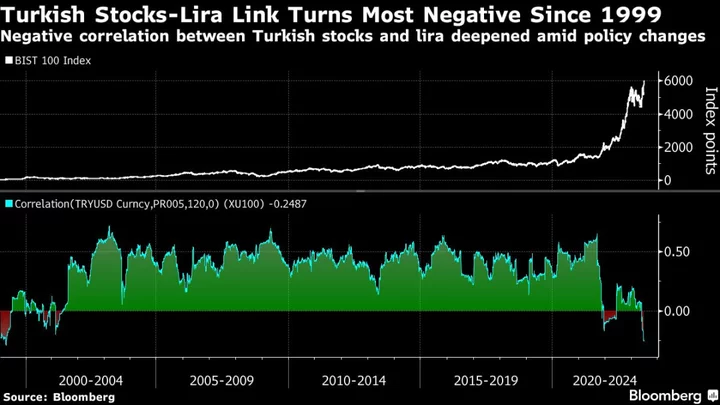

Turkey’s currency and stocks have decoupled from each other by the most in a quarter century as local and foreign investors respond differently to the nation’s return to orthodox policies.

The lira sank to record lows after the central bank’s first interest-rate hike in two years trailed expectations and authorities paused their defense of the currency. Meanwhile, stocks have scaled new highs with inflation near 40% pushing citizens to use them as a store of value. The contrasting moves have turned a historical positive correlation between the two assets to the most negative since 1999.

“Coupled with nearly all-time low equity valuations, local investors find good reasons to switch to equities as the quickest way to protect against future inflation,” said Emre Akcakmak, a Dubai-based senior consultant at East Capital International. “For foreigners, the idea is to see the local currency weak enough so they can bet on the likely earnings revisions and valuation upside.”

Turkey has signaled an economic rethink after elections in May returned President Recep Tayyip Erdogan to power. His new team including Treasury and Finance Minister Mehmet Simsek and central-bank Governor Hafize Gaye Erkan has backed the shift, though advocating a gradual move. In a break from Erdogan’s unorthodox beliefs that had left borrowing costs too low in the face of runaway inflation, policymakers last month raised the repo rate by 650 basis points.

“On the monetary policy front, the market seems to be pricing in a positive what-if scenario by taking into account a likely normalization along with gradual rate hikes and policy simplification,” Akcakmak said.

On Wednesday, HSBC raised its recommendation for Turkish equities to overweight from neutral and said gradual pace of policy changes may make the country’s stocks more attractive to foreign investors by making it easier for them to build positions.

The lira has weakened 23% versus the US dollar since the ballot on May 28. The equity index has rallied 31% in the same ‘period. The 120-day rolling correlation between the two has fallen to a coefficient of minus 0.3.

For years, Turkey’s monetary policy has been influenced by Erdogan’s theory that higher interest rates fuel inflation. As a result, borrowing costs were cut to levels that markets interpreted as too loose, sparking frequent selloffs in the lira. On most such occasions, state lenders would step in regularly to defend the currency.

That approach was relaxed after the Turkish President appointed two former Wall Street bankers to run the country’s finances, prompting hopes that the country would turn to more orthodox economic and monetary policies. State support to the currency has become more sporadic and limited.

But the new paradigm could well be a double-edged sword. While rate hikes might help to defend the lira, the lack of frequent dollar sales leaves the currency more prone to selloffs. That, in turn, risks stoking inflation further. That’s a reason Turkish investors are again using stocks as a hedge against inflation, after resorting to the trend in 2022.

Turkey had the smallest deceleration in consumer prices in June since a slowdown that began last November as one of the lira’s worst stretches in decades makes imports more expensive.

“The number of companies that are affected positively from weak currency, — exporters, aviation— and high inflation —retailers— have high weight in the stock market and they are pushing the index upwards,” said Burak Isyar, head of research at ICBC Turkey Investment in Istanbul.

(Updates with HSBC report, inflation data in sixth and 11th paragraphs)