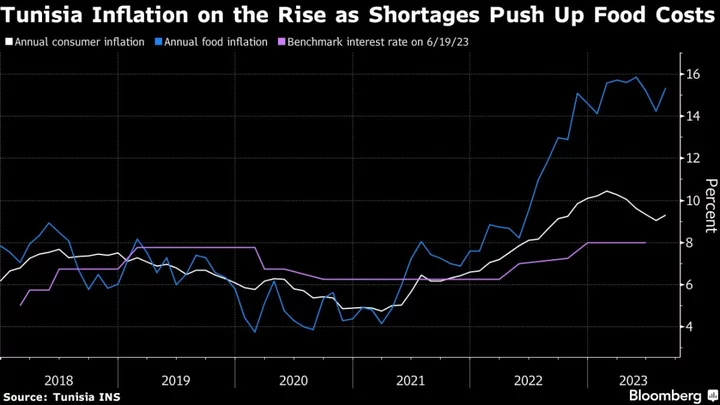

Tunisia’s central bank kept its benchmark interest rate unchanged despite a pick-up in inflation, as political tensions hinder reform efforts needed to obtain a loan from the International Monetary Fund.

Banque Central de Tunisie kept the rate at 8%, the regulator said in a statement following a board meeting Thursday.

The “current stance of the monetary policy will support a further easing of inflation over the coming period,” it said. Still, it added that the risks of a further acceleration “are significantly tilted to the upside.”

The year-on-year inflation rate sped up in August to 9.3%, breaking a downward cycle that lasted for much of the year.

The central bank has kept rates unchanged since December, when it raised them by 75 basis points. It said it was ready to act should inflationary risks worsen.

Tunisians are suffering from chronic shortages of food staples after the cash-strapped state tried to curb imports. Many form early morning queues for bread, while a drought this year has hit the local wheat harvest.

The scarcities also apply to sugar, coffee and milk, and recently extended to soft drinks as the country runs short of carbonic gas.

“We are tired,” a Tunisian citizen told President Kais Saied while he was touring the city of Ariana last month.

Saied responded: “I know that you are tired. And I too am tired.”

Read also: Tunisia’s Leader Takes Hard Line on Austerity in IMF Faceoff

The president assumed almost absolute powers in 2021, a move he said was aimed at ending corruption and mismanagement over the past decade. But his increasingly hardline approach and reluctance to sign off on reforms called for by international institutions have further stoked worries about Tunisia’s default risk.

While the country has signed a $1.9 billion IMF program, it hasn’t received final approval from the Washington-based lender’s board. The IMF is seeking broad economic changes, including cost-cutting measures the president says are untenable.

Read also: How Tunisia’s Migrant Crackdown Muddles Bailout Talks: QuickTake

A $500 million loan from Saudi Arabia in July boosted Tunisia’s coffers. But it needs far more money to repay debts maturing over the next two years.

Tunisia has some of the highest bond yields in the world, signaling investors’ nervousness. The government’s $1 billion of notes maturing in early 2025 trade at just 69 cents, giving them a yield of 37%.

The government is expected to outline budgetary plans before the end of October. That’s expected to give some clarity regarding its commitment to securing the IMF bailout.

Author: Tarek El-Tablawy and Souhail Karam