Taiwan Semiconductor Manufacturing Co. posted a smaller than expected profit decline, after the global AI development boom outweighed a persistent slump in smartphone demand.

The main chipmaker for Apple Inc. and Nvidia Corp. reported net income of NT$181.8 billion ($5.85 billion) for the June quarter, versus the average analysts’ estimate of NT$173.6 billion.

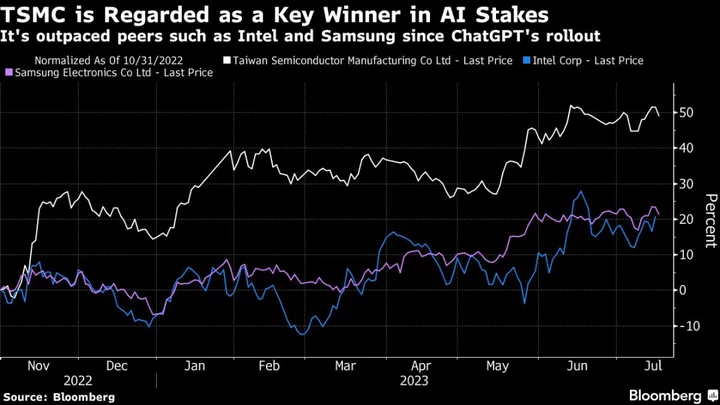

TSMC is viewed as among the earliest beneficiaries of efforts from the US to China to develop artificial intelligence platforms. The Taiwanese company, which makes the Nvidia chips considered most effective at training AI such as ChatGPT, has gained some 30% in value this year as investors hunt for ways to bet on the emergent technology.

More immediately however, the iPhone chipmaker is struggling to sustain margins and growth in its smartphone and consumer-oriented business, which has shrunk alongside a global post-Covid economic downturn. TSMC reported a 10% decline in second-quarter revenue last week, a little narrower than feared.

Click here for a live blog on TSMC’s numbers.

What Bloomberg Intelligence Says

Despite reporting consensus-beating sales in 2Q of NT$480.8 billion and a swift rise in AI chip-related fabrication orders, TSMC’s earnings trajectory in 2H could still be significantly dragged down by a sluggish smartphone sector. After adjusting for foreign-exchange fluctuations, 2Q revenue stands at just the midpoint of the guidance range and 10% lower than a year earlier.

- Charles Shum, analyst

Click here for the research.

Samsung Electronics Co. this month reported its worst decline in quarterly revenue since at least 2009, stoking uncertainty over when a year-long electronics demand slump will end. Last month, TSMC warned capital expenditure — a key indicator of future demand because it front-runs sales — should wind up closer to the bottom end of a previously forecast $32 billion to $36 billion range. Executives also reaffirmed projections for a low- to mid-single-digit revenue decline in 2023.

Global smartphone shipments plunged 11% in the April to June period, the sixth successive quarterly decline, research firm Canalys estimates. But backlogs of unsold phones are shrinking. And this week, ASML Holding NV revealed orders rose in the second quarter after demand for its chip-making machines picked up.

“The smartphone market is sending early signals of recovery,” said Le Xuan Chiew, an analyst at Canalys. “Smartphone inventory has begun to clear up as smartphone vendors prioritized cutting inventory of old models to make room for new launches.”

Investors are betting on TSMC becoming a heavyweight in the global race to develop next-generation AI. Top customer Nvidia’s chips are essential to ChatGPT, autonomous driving and a new generation of AI products. The US firm’s valuation briefly surpassed $1 trillion this year thanks to Wall Street’s obsession with generative AI, propping up the fortunes of TSMC and other electronics firms that supply the infrastructure needed to train AI models.

Other investors — including Warren Buffett — worry that growing Chinese aggression might jeopardize Taiwan’s precarious position and thus TSMC’s prospects. It still keeps its most advanced manufacturing at home, despite US warnings that Beijing might decide to try to retake an island it considers its own.

To mitigate concerns from customers over geopolitical uncertainties in the Taiwan Strait, TSMC has been diversifying its manufacturing footprint over the past two years. It is investing $40 billion to create two fabs in Arizona and constructing an $8.6 billion facility in Japan with financial support from the government. The company remains in discussions with Tokyo over subsidies for a second facility, which might be located alongside its current plant in Kumamoto.

--With assistance from Gao Yuan.