A faster-than-expected decline in the US Treasury Department’s cash balance is leading market participants to question whether the government will be able to make it until mid-June tax payments, potentially dashing hopes for a late-summer deadline.

That’s the latest take from money-market analysts who track the government’s cash position, and market pricing paints a similar picture, with bill yields suggesting investors see elevated risk starting in early June.

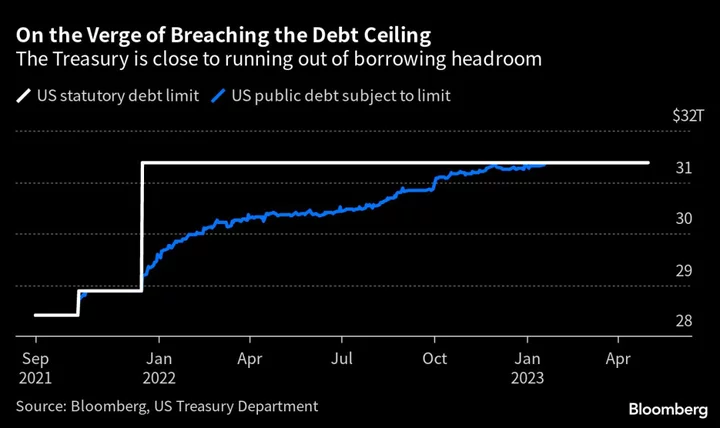

The Treasury’s cash balance fell to $87 billion on Monday from about $140 billion Friday, partially due to an unexpectedly large volume of state and local-government securities redemptions, according to data published Tuesday. Treasury Secretary Janet Yellen reiterated to lawmakers this week that her department’s ability to avoid breaching the statutory debt ceiling via special accounting maneuvers could be exhausted around early June. The window for a resolution of the standoff is clearly narrowing, with the Treasury saying last week that it had run through all but about $88 billion of its authorized extraordinary measures as of last Wednesday.

Talks between White House and congressional aides are set to intensify as negotiators seek a framework agreement for Joe Biden and House Speaker Kevin McCarthy to review upon the president’s return from a trip to Asia. The latest round of discussions, launched before Biden’s departure Wednesday for a Group-of-Seven gathering in Japan, will feature a narrower group of negotiators in hopes of producing a deal.Biden on Wednesday expressed confidence that negotiators would reach an agreement to avoid a catastrophic default. The president and lawmakers struck a cautiously optimistic tone after a meeting Tuesday, saying that while the two sides remained far apart, they were hopeful the new negotiating teams could find bipartisan middle ground.

There are many in financial markets predicting or hoping that some kind of deal will get done, in part because that’s what’s always happened, even when things have gone down to the wire. Equity markets seem to expect a deal but ``if the positive tone from Washington is misleading, or if talks break down, then equities could sell off,’’ Brian Gardner, Stifel Financial’s chief Washington policy strategist, wrote in a May 17 note to clients. He added that investors should remain wary pending further clarity on the progress of negotiations.

From Washington to Wall Street, here’s what to watch to gauge how worried observers should be and when they should be concerned.

X-Date Predictions

Underpinning the various moves in debt markets are differing estimates about when the government might exhaust its options to fund itself — commonly referred to as the X-date. While the administration has provided guidance that it might fall short as soon as June, prognosticators across Wall Street have also been running the numbers based on government cash flows and expectations around taxes and spending. Some strategists have pulled forward estimates to align more with forecasts out of Washington. Others, meanwhile, are staying with late-summer projections. Recent cash-flow figures from the Treasury suggest that it’s even more unclear whether the department will make it until June 15, a key tax-payment day.

The Bills Curve

Investors have historically demanded higher yields on securities that are due to be repaid shortly after the US is seen as running out of borrowing capacity. That puts a lot of focus on the yield curve for bills — the shortest-dated Treasury securities — and any dislocations that show up. Noticeable upward distortions in particular parts of the curve tend to suggest increased concern among investors that that’s the time Uncle Sam might be at risk of default. Right now that’s most prominent around early June. The Treasury on Wednesday sold $39 billion of 17-week bills at 5.10%. The auction was $3 billion larger than the previous week's.

The Cash Balance

The US government’s ability to pay its debts and meet its spending obligations ultimately comes down to whether it has enough cash, so the amount sitting in its checking account is crucial. That figure fluctuates daily depending on spending, tax receipts, debt repayments and the proceeds of new borrowing, and if it gets too close to zero for the Treasury’s comfort that could be a problem. The larger-than-anticipated drop in the Treasury’s cash balance Monday suggests the prospects for avoiding a June X-date have worsened, according to Wrightson ICAP.

Insuring Against Default

Beyond T-bills, one other key area to watch for insight on debt-ceiling risks is what happens in credit-default swaps for the US government. Those instruments act as insurance for investors in cases of non-payment. The cost to insure US debt is now higher than the bonds of — among others — Greece, Mexico and Brazil, which have defaulted multiple times and have credit ratings many rungs below that of the US.

Related Story: US Default Insurance Cost Eclipses Brazil, Mexico as X-Day Nears

Wrangling in Washington

Ultimately though, any fix will need to come from Washington. There aren’t that many days this month when both chambers of Congress are available and Biden is also scheduled to be in the US capital, meaning there isn’t a lot of time to waste to reach a deal before the X-date.

Related Story: Budget Talks Inch Forward as Debt Deadline and Biden Trip Near