Yields on US Treasury bills that mature in early June have resumed climbing as the federal government’s coffers dwindle to the lowest level in almost a year-and-a-half, increasing pressure on lawmakers to strike a deal to raise the debt limit as negotiations show signs of faltering on Capitol Hill.

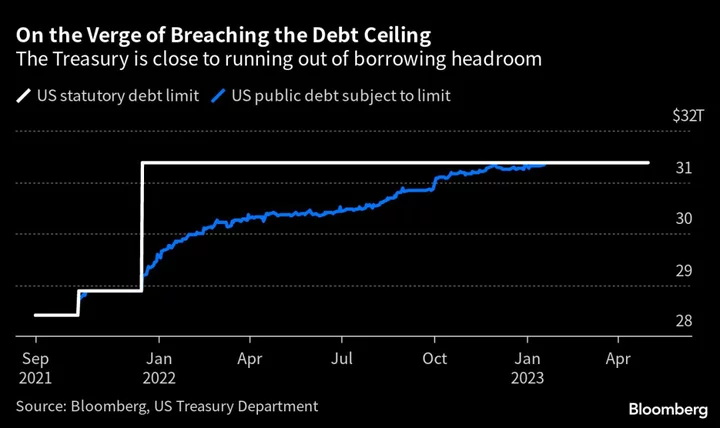

The government’s cash balance fell to $57.3 billion on Thursday from about $68.3 billion the day before. That underscores how quickly the window for resolving the standoff is narrowing, with the Treasury saying on Friday that it had run through all but about $92 billion of its authorized extraordinary measures as of May 17. At the end of last week, the department had about $140 billion in its coffers and around $88 billion of additional room freed up under the $31.4 trillion debt cap.

While politicians in Washington this week have expressed optimism about a deal being imminent, the two sides still appear to have a considerable way to go. Debt-limit negotiations hit a wall Friday as House Speaker Kevin McCarthy blamed the White House for resisting spending cuts, casting doubt on efforts in Washington to avert a catastrophic default.

Treasury Secretary Janet Yellen told top bank executives Thursday that a failure to raise the debt ceiling would be “catastrophic” for the financial system. She “discussed the urgent need for Congress to address the debt limit and underscored the real and severe consequences of default for the banking system and the domestic and global economy,” the Treasury said in a statement following her meeting with more than two dozen chief executive officers and other executives convened by the Bank Policy Institute.

T-bills maturing after the potential so-called X-date — when the Treasury runs out of room to maneuver — have been trading with a significant yield premium because of concerns about a default. They continued to do so on Friday, with the most notable dislocations in those due June. At the same time, the cost of insuring US debt against non-payment has also soared in recent weeks, though the impact has been far smaller in other markets as traders speculate that an agreement will be struck. That could change if the situation gets more fraught.

There are many in financial markets predicting that some kind of deal will get done, in part because that’s what’s always happened, even when things have gone down to the wire.

From Washington to Wall Street, here’s what to watch to gauge how worried observers should be and when they should be concerned.

The Bills Curve

Investors have historically demanded higher yields on securities that are due to be repaid shortly after the US is seen as running out of borrowing capacity. That puts a lot of focus on the yield curve for bills — the shortest-dated Treasuries. Noticeable upward distortions in particular parts of the curve tend to suggest increased concern among investors that that’s the time the US might be at risk of default. Right now that’s most prominent around early June. While yields pared their rise on Thursday amid optimism of a deal, the drop has since been reversed.

X-Date Predictions

Underpinning the various moves in debt markets are differing estimates about when the government might exhaust its options to fund itself — commonly referred to as the X-date. While the administration has provided guidance that it might fall short as soon as June, prognosticators across Wall Street have also been running the numbers based on government cash flows and expectations around taxes and spending. Some strategists have pulled forward estimates to align more with forecasts out of Washington. Others, meanwhile, are staying with late-summer projections. Recent cash-flow figures from the Treasury suggest that its remaining spending capacity is rapidly dwindling.

The Cash Balance

The US government’s ability to pay its debts and meet its spending obligations ultimately comes down to whether it has enough cash. So the amount sitting in its checking account is crucial. That figure fluctuates daily depending on spending, tax receipts, debt repayments and the proceeds of new borrowing. If it gets too close to zero for the Treasury’s comfort that could be a problem. The government’s coffers have dropped to the lowest level since December 2021, deepening concern that it will run out of funds by early next month if the debt limit isn’t raised or suspended before then.

Insuring Against Default

Beyond T-bills, one other key area to watch for insight on debt-ceiling risks is what happens in credit-default swaps for the US government. Those instruments act as insurance for investors in cases of non-payment. The cost to insure US debt is now higher than the bonds of — among others — Greece, Mexico and Brazil, which have defaulted multiple times and have credit ratings many rungs below that of the US.

Related Story: US Default Insurance Cost Eclipses Brazil, Mexico as X-Day Nears

(Updates to reflect latest figures on Treasury’s cash balance)