South Africa’s Transnet SOC Ltd. has a turnaround plan to ease port and rail snarl-ups that have hamstrung the continent’s biggest economy. It just needs money.

And while state-owned companies could rely on government bailouts in the past, the massive amount of funding pumped into power utility Eskom Holdings SOC Ltd. in recent years has made asking the National Treasury for a handout more difficult for the next in line. In this case, it’s Transnet.

Eskom’s latest relief package of 254 billion ($13.8 billion) in conditional debt came with strings attached in the form of performance targets. In Transnet’s case, the government wants to see progress on its turnaround plan before disbursing any money, Finance Minister Enoch Godongwana said in his mid-term budget statement on Nov. 1.

Transnet wants its request for a bailout to be considered on the merits of its turnaround plan, rather than being lumped together with Eskom, because the success of its strategy partly relies on government funding, Chairman Andile Sangqu said in an interview during a train journey on Friday between Johannesburg and Pretoria.

“You can’t have a blanket approach,” he said. “If you look at our recovery plan, it’s predicated on number one: operational reforms in which we believe that there are some efficiencies that can be unlocked. And I think if we do that, we’ll able to improve our tempo and our cadence in terms of the volumes and that will assist with the turnaround.”

Rail inefficiencies in 2022 cost South Africa’s economy 411 billion rand, and worsened the government’s tax shortfall, according to budget data. Deteriorating rail infrastructure and rolling stock has meant that exporters can’t get their product to ports. Offloading at container terminals can take weeks because of equipment failure and low productivity.

To support its recovery plan, Transnet requested an equity injection from the state as its 130 billion-rand debt pile means it’s unable to fund itself in capital markets. The company “has ongoing engagements” with the Treasury, Transnet said in a response to questions, without providing details on the amount of relief requested.

Transnet’s performance deteriorated rapidly over the past decade as corruption and mismanagement during the administration of former President Jacob Zuma took their toll, followed by pandemic-induced losses. A surge in infrastructure theft and restrictive graft-prevention measures by the Treasury deepened the malaise. Portia Derby, appointed three years ago as chief executive officer to fix the business, left last month as the situation grew worse.

There’s little time to waste and funding is paramount, Sangu said.

“Every day counts in the sense that we’ve set up goals in terms of where we want to be,” he said. “We understand the fact that there are processes, but the fact of the matter is the clock is ticking.”

Earlier this month, the company rolled over 7 billion rand of debt due Nov. 6 by issuing short-term paper to the Public Investment Corp., which oversees South African government pension funds. That debt is due to be repaid in March, giving Transnet less than four months to effect a turnaround and convince the government it deserves help.

Moody’s Investors Service on Nov. 10 put the company’s rating on review for downgrade, citing concern that Transnet’s liquidity profile is weakening.

“Funding will be difficult,” said Jan Havenga, an emeritus professor at Stellenbosch University, who specializes in logistics. Still, with help from the Treasury — which could include debt restructuring and a capital injection of 20 billion rand for two years — the company could be turned around, he said.

Coal Trucks

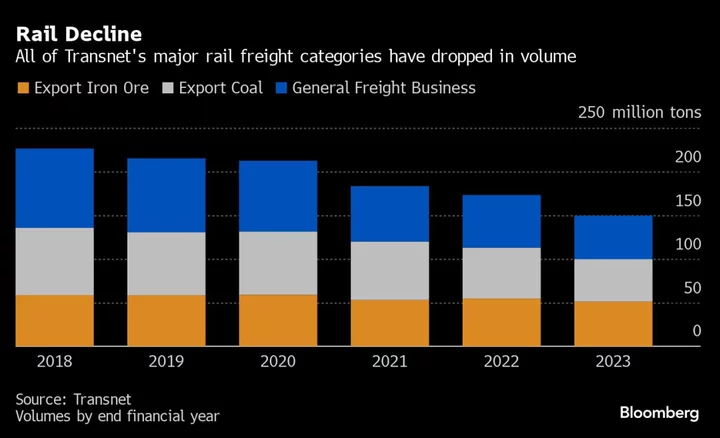

Volumes hauled by the freight rail division, which accounts for 43% of group revenue, have declined by a third since 2018, according to Transnet’s annual report.

Transnet’s export coal shipments, delivered from mines owned by Anglo American Plc spinoff Thungela Resources Ltd. and Glencore Plc, have dropped for four consecutive years. That resulted in the lowest volumes leaving Richards Bay Coal Terminal in decades.

The deteriorating rail situation was illustrated vividly during a tour last week showcasing Transnet’s rail facilities: the event was delayed as a result of vandalism and theft of copper cables along the tracks, while broken signals forced the train driver to take instructions from the main control room via mobile phone.

The failure of rail transport has forced exporters to turn to roads, putting thousands of heavy trucks a day on routes to the coast. The traffic congestion has become so severe that Transnet is looking to source land in the area surrounding Richards Bay to use as a staging area for the rigs to park.

Old Ports

Transnet’s port terminal business represents about a fifth of revenue and also faces mounting troubles. Extreme weather conditions and rains have damaged equipment that was already poorly maintained, resulting in vessels waiting nearly three weeks at anchor, Earle Peters, managing executive for Transnet Durban Terminals, said in a presentation. The hub handles more than 40% of South Africa’s port traffic.

Shipping companies A.P. Moller-Maersk and MSC Mediterranean Shipping Co SA have announced surcharges of more than $200 a container due to South African port congestion.

Transnet is implementing measures to clear the backlog that will last months into 2024. Buying cranes and other measures to meet longer-term targets will require funding.

“Our priority is to mitigate the situation, and we are regularly communicating the contingency plans to our customers to ensure they can plan their supply chains accordingly,” Lubabalo Mtya, Maersk’s managing director for southern Africa and Indian Ocean Islands, said in a statement.

Even if Transnet’s recovery plan is enough on paper to fix the business, securing needed funding will be a challenge, said Carmen Nel, head of multi-asset strategy at Terebinth Capital Ltd.

“The bailout and effective debt transfer provided to Eskom has created moral hazard, making it difficult for the Treasury not to deal with Transnet in a similar manner,” she said. “Treasury will apply more stringent conditions and a more thorough process.”

--With assistance from Monique Vanek and S'thembile Cele.