Bets that the Bank of England is getting closer to lowering UK interest rates are misguided, according to bullish pound traders, who say a key inflation reading next week could spur a rally in the currency.

Sterling ended the week at its lowest level against the euro since May after BOE Chief Economist Huw Pill fanned speculation of interest-rate cuts next year. Strategists at Credit Agricole SA and Bank of America Corp. say those wagers are overstretched setting the pound up to rally as they unwind.

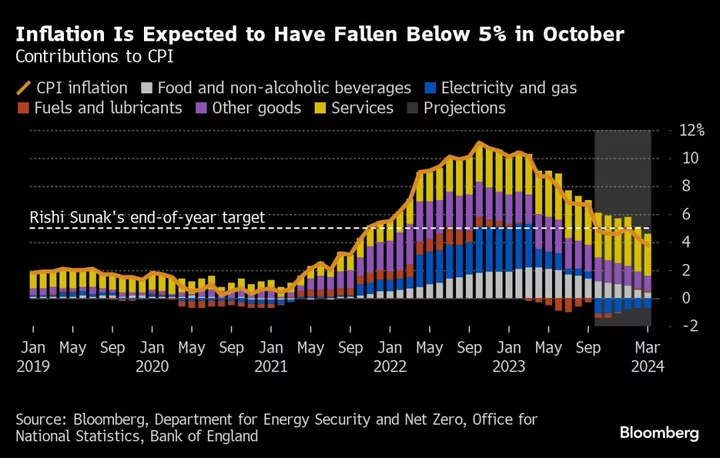

While Wednesday’s headline inflation print is forecast to fall significantly, it’s largely due to energy prices. Should a closely-watched measure of prices for services remain hot, or if the overall slowdown proves shallower than expected, then UK bond yields will need to adjust higher — taking the pound with them.

“Many negatives are already in the price of sterling,” said Valentin Marinov, head of G-10 currency strategy at Credit Agricole, who recommends snapping up the pound when it’s cheap versus the euro and US dollar. “Rates markets are overreacting to what we still consider to be fairly neutral and very data-dependent forward guidance by the monetary policy committee.”

After a historic tightening campaign by the BOE, traders are getting increasingly comfortable with the idea that the central bank’s key rate has peaked. They predict policy makers will pivot to easing from the middle of next year, with market pricing implying almost three quarter-points of rate cuts by the end of 2024.

That’s drawn a mixed reaction from BOE officials.

Governor Andrew Bailey said it’s too early to talk about cuts, but failed to push back on market pricing as forcefully as in the past.

Pill’s comments that rate cuts may be on the table by the middle of 2024 were interpreted by some as a validation of the rate trajectory plotted by the market. But others pointed to possible caveats: he noted global events could shift the timing and didn’t repeat the sentiment on cuts in a speech later in the week.

“Market pricing for UK rate cuts into next year seems inconsistent with rhetoric from the BOE,” said Kamal Sharma, a strategist at BofA. “We believe that the profile resembles more of a table top rather than a downward sloping curve. Pricing out those rate cuts provides support for the pound.”

The Bank of England expects the inflation rate to have dropped in October to 4.8%, while economists predict a slightly larger fall to 4.7%. The BOE said it sees inflation slowing further to 4.5% this year.

Pill warned last week that services remain a “key risk” to the BOE’s price outlook. The sub-gauge unexpectedly accelerated to 6.9% from 6.8% in September, according to the last release.

“We will be paying close attention to wage sensitive components within the CPI basket, specifically within services industries,” said Nick Rees, a currency analyst at Monex Europe. Should they drop, “markets will begin to take confidence that the BOE’s previous actions are finally loosening the labor market and breaking the back of inflation,” he said.

The economic headwinds for the UK remain large. Orla Garvey, a fixed-income portfolio manager at Federated Hermes, said there’s still room to price more gains for shorter-maturity gilts, which will beat peers, though the pace of the advance will slow. UBS Group AG economists predict inflation for October slowed to 4.5%, while its markets team recommends selling the pound against the Swedish krona.

“The fundamental outlook has begun to soften again in the UK, prompting investors to question whether the BOE’s hawkish stance can be maintained for much longer,” said Yvan Berthoux, a strategist at UBS.

But even if inflation comes in low, the market may “misread” it, according to Hank Calenti, senior fixed income strategist at SMBC Nikko Capital Markets.

While the BOE will interpret any inflation drop as being driven by falling energy prices, “the market is myopic and will only see lower,” he said.

“I think at least one more hike, but can not rule out two from here.”

--With assistance from James Hirai.