For all of the times this year that Wall Street has been caught off guard by the moves in technology stocks, the last few days have proved many investors right.

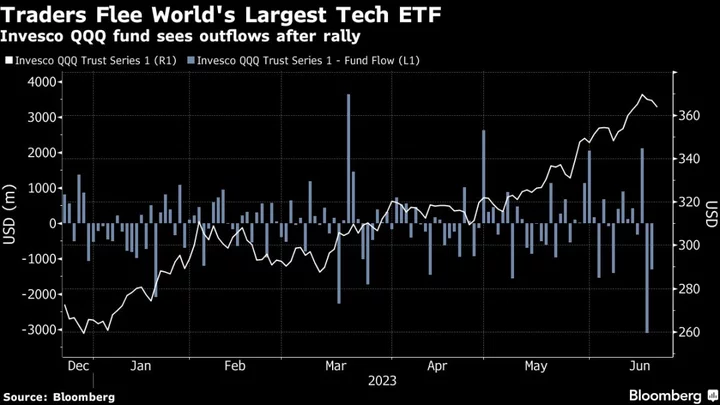

Traders dumped $3.1 billion from the Invesco QQQ Trust Series 1 ETF (ticker QQQ) on Friday, just as the exchange-traded fund snapped a six-day winning streak. The product, which tracks the Nasdaq 100, has now fallen nearly 2% since the cash exit. Traders have continued to move away from the fund this week, pulling an additional $1.3 billion on Tuesday.

Comments from Federal Reserve Chair Jerome Powell that higher rates will be needed to combat inflation helped take steam out of a blistering artificial intelligence-led rally in technology stocks.

“Some people are really just convinced that the AI-beneficiaries have run too far, too fast and now they’re getting worried,” said Lauren Sanfilippo, senior investment strategist at Bank of America Private Bank and Merrill.

The Friday outflow also coincided with a large amount of options-related activity. About $4.2 trillion of futures and options contracts tied to stocks and indexes matured on Friday. QQQ’s combined call and put open interest totaled over 17 million contracts at the end of last week, the highest level since 2004.

Pension funds rebalancing their stock allocations may also be behind the large trades, according to Dave Lutz, head of ETFs at JonesTrading.

After the outperformance of stocks over bonds this quarter, JPMorgan Chase & Co. estimates that global pension funds may need to sell roughly $150 billion worth of equities to keep their required stock-bond allocation targets in check. Technology stocks that have outperformed every other equity sector this quarter are ripe for that selling.

“If you have a target-weight fund, you are a tech seller right now,” said Andrew Lekas, head of FICC trading at Old Mission Capital.