Traders are abandoning the euro at pace as speculation grows the European Central Bank will struggle to tighten monetary policy further, even with inflation running far above target.

Data this week showed consumer-price growth re-accelerated in Spain and France in August, but the market is betting the ECB’s cycle of interest-rate hikes is as good as over. After a string of poor economic figures and comments from ECB member Isabel Schnabel on dire outlook, the odds of a pause at the next meeting now hang in the balance.

Concern that Europe faces stagflation — a combination of weak economic activity and high inflation — has led many bulls to capitulate and dragged the euro lower. It fell as much as 0.4% to $1.0885 on Thursday, taking losses from a peak in July to more than 3%.

Analysts have cut their median forecast for the currency for the first time in six months, while firms including Bank of America Corp. and JPMorgan Chase & Co. see it falling toward $1.05, a level last seen during the banking crisis in March. BNP Paribas Asset Management says it could reach $1.02.

“The economy is clearly weakening, but core inflation remains stuck. If the weakness we have seen so far is not enough to bring inflation down, the economy needs to weaken even more,” said Athanasios Vamvakidis, head of G-10 FX strategy at Bank of America. “That’s the main concern for the euro.”

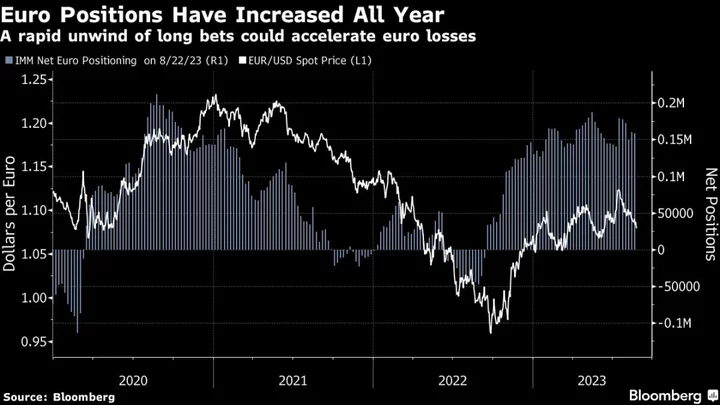

Back in January, when inflation had just peaked at double digits and the ECB hiking cycle was in full swing, several analysts were bullish. Both leveraged funds and institutional investors have held a net long position on the euro for nearly a year, helping the currency steadily recover from a two-decade low reached in late 2022.

Now though, the outlook is far less clear.

While consumer-price growth has eased materially, data due later on Thursday is expected to show inflation is still running far too hot. At the same time, weak PMI data released last week suggests the impact of rate increases is finally beginning to show.

“Under this scenario, the market should be questioning if it remains too long euro,” said Jane Foley, head of currency strategy at Rabobank.

As far as money markets are concerned, policymakers will wrap up the tightening cycle after a final quarter-point hike to 4% later this year, but will opt for a pause in September.

Analysts meanwhile have adjusted their expectations, with the median forecast in a Bloomberg survey dipping to $1.10by the end of the year, from $1.12 just last week.

On the technical side, momentum indicators have softened, with a break of the euro-dollar 200-day moving average clearing the way for more losses. Options markets suggest traders are growing bearish, with the premium to own downside exposure widening lately.

Adding to the pressure on the euro area is a brewing economic crisis in China, which is a bigger trading partner for the bloc than the US. Slowing Chinese demand could crimp exports from Germany and other countries in the region.

“We have shifted from a market narrative of a ‘soft landing’ US disinflation theme to the risk of a slowdown in China and Europe developing as the new narrative,” Nomura’s currency strategist Jordan Rochester wrote in a note.

Even HSBC Holdings Plc’s Dominic Bunning, who has one of the highest forecasts for the euro by the end of the year at $1.15, said it is becoming “harder and harder” to stay bullish as the data downturn in recent weeks signals a “cyclical challenge.”

Given the divergence in the economic outlook for Europe and the US, Peter Vassallo, a portfolio manager at BNP Paribas Asset Management, said the euro should be trading close to $1.02 — not far off the lowest level against the dollar in two decades reached last year.

“I’m actually surprised the selloff in recent weeks has not been more dramatic,” he said. “When we talk about the resilience of global growth and the resilience of the world economy, really what it is is US resilience.”

--With assistance from Dayana Mustak, Alice Gledhill and Craig Stirling.

(Adds latest inflation figures and Schnabel’s comments in second paragraph. Updates prices throughout.)