International funds will resume investing in Thailand, boosting equities and the baht, following the appointment of a new prime minister after a three-month political impasse triggered withdrawals, according to the nation’s largest private money manager.

Parliament’s endorsement of Srettha Thavisin will boost confidence that the coalition government headed by his Pheu Thai party can get on with implementing measures to spur economic growth, according to SCB Asset Management Co. Southeast Asia’s second-biggest economy delivered slower-than-expected expansion during the second-quarter.

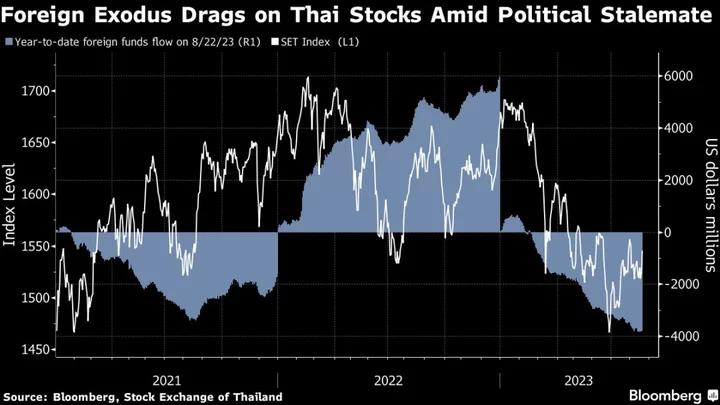

The benchmark SET Index has slumped 7.4% this year, with expectations of a rally after the nation’s May 14 election dashed as parliament blocked the appointment of a premier from the party that won most votes. Foreign investors have withdrawn almost $4 billion this year from Thailand’s equities as confidence was eroded by the political stalemate, slowing exports and higher interest rates.

READ: Thaksin Ally Elected New Thai PM, Ending Three-Month Impasse

“Most foreign funds should be more optimistic about Thailand’s economic outlook after the resolution of the prolonged political deadlock,” said Varorith Chirachon, an executive director at SCB Asset, which manages about $51 billion. “Srettha’s Pheu Thai party has a clear plan for new stimulus that should significantly help the economy at this critical time.”

Srettha, a former property tycoon, is Thailand’s first new leader since 2014, when former army chief Prayuth Chan-Ocha staged a coup. After forging a coalition that includes military aligned parties, Srettha won a majority of votes in a joint sitting of the parliament’s two chambers on Tuesday. Srettha, 61, can form a cabinet once his appointment is officially endorsed by the head of state, King Maha Vajiralongkorn.

Stocks and the baht rallied on Tuesday before the parliamentary vote was completed in anticipation of Srettha’s success. The SET Index jumped 1.3%, the most since July 14, as foreign investors bought a net $15 million. The baht climbed 0.5% against the dollar to its highest level in two weeks. The benchmark and currency were little changed today.

The deterioration in China’s growth outlook will continue to pressure the baht, according to RBC Capital Markets, noting that this year’s target for Chinese tourists won’t be met.

With political risk easing, “growing downside risks to China’s growth outlook suggests that there will be headwinds to dollar-baht breaking under 34,“ said Alvin Tan, head of Asia FX strategy at RBC in Singapore. “The baht has outperformed among Asian currencies in recent days on the back of the post-election political stasis being resolved,“ he said.

The Pheu Thai-led coalition has pledged to push through with promised policies including a 10,000 baht ($286) digital wallet for all Thais, a 600 baht minimum daily wage, a base salary of 25,000 baht for university graduates and higher crop prices.

Still, Thai equities’ gain will probably be tempered than four years ago when Prayut Chan-Ocha won the parliament’s vote to be the prime minister in 2019, according to Nuttachart Mekmasin, an analyst at Trinity Securities Pcl in Bangkok. A slow rebound in corporate earnings will curb any further rally in the domestic stocks, he said.

--With assistance from Marcus Wong.

(Adds analysts’ comments in eighth and 10th paragraph.)