Semiconductor Manufacturing International Corp. quarterly revenue fell for the third straight quarter, reflecting the impact of a global smartphone slump and Washington’s broadening campaign to curb China’s technology sector.

The Shanghai company reported a 15% fall in revenue to $1.62 billion, versus an average projection for $1.64 billion. Net income fell 80% to $94 million, compared with estimates for $178.1 million. The numbers missed despite hopes that the surprise popularity of a new range of Huawei Technologies Co. 5G smartphones would help offset lost sales.

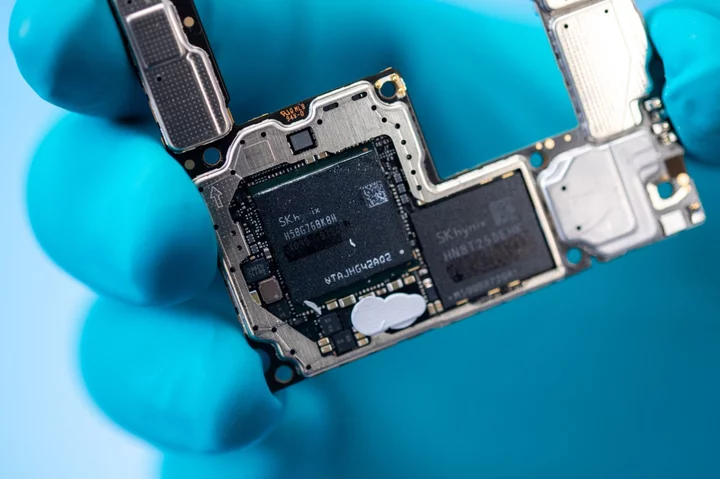

SMIC is one of the highest-profile companies at the heart of Beijing’s ambitions to build a world-class tech sector less reliant on American innovations. China’s largest chipmaker helped Huawei build the 7-nanometer processor for the Mate 60 Pro, regarded as a major achievement for two companies that the US blacklisted years ago over national security concerns. Riding a wave of nationalist fervor, the device has sold out rapidly, taking business away from the iPhone.

Huawei itself shows signs of resuming the growth that Washington’s sanctions derailed. State-backed SMIC is projected to return to growth in the peak December quarter, but its prospects may hinge on whether the US — which last month expanded existing curbs on China’s chip sector — is contemplating further sanctions. US lawmakers have called for more restrictions, seizing on Huawei’s unexpected breakthrough.

Shares of SMIC have climbed roughly 40% since Huawei introduced the $900-plus Mate 60 Pro in late August — just as US Commerce Secretary Gina Raimondo — whose department oversees the complex network of restrictions on chips — was visiting China. The company’s executives are expected to take questions about Huawei and its longer-term chip plans on Friday morning.

“Robust demand for Huawei devices, from servers to handsets, underscores local support for domestically produced chips, potentially sustaining the company’s capacity utilization beyond expectations,” Bloomberg Intelligence Analyst Charles Shum wrote in a note ahead of the results release.

Despite the boost from Huawei, SMIC continues to grapple with uncertainty in China’s smartphone market — the world’s largest.

Competition is intensifying in the Chinese smartphone market, which is already crowed with players from Xiaomi Corp. to Oppo and struggling to recover from a Covid-era slump.

Smartphone shipments in the country fell 5% in the third quarter and none of the top five players sold more phones than a year ago, according to research firm Canalys. Major Chinese smartphone makers rely on Qualcomm Inc. and MediaTek Inc. for chip supply, but those two firms also outsource manufacturing to overseas contractors such as Taiwan Semiconductor Manufacturing Co. and Globalfoundries Inc.

Longer-term, it remains to be seen whether Beijing’s overt support for the company and chip-related firms will pop up the bottom line.

“China’s drive toward semiconductor self-sufficiency appears to buffer SMIC against anticipated 3Q headwinds in sales and profit margins, despite broader market challenges from stagnant smartphone and consumer-electronics recoveries,” Shum wrote in a note ahead of the results release.

--With assistance from Filipe Pacheco.