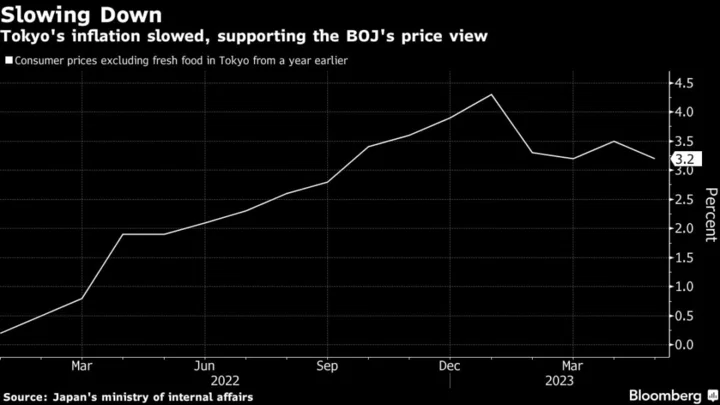

Inflation in Tokyo slowed, supporting the Bank of Japan’s view that prices will likely slow toward the autumn, although the high levels will likely continue to drag on household spending.

Consumer prices excluding fresh food climbed 3.2% in the capital in May, slowing from the previous month, according to the ministry of internal affairs Friday. The reading was weaker than economists’ forecast of a 3.4% gain.

Still, there were also signs that the deeper inflation trend may be continuing to strengthen.

Tokyo data is a leading indicator of the nationwide trajectory of prices.

The deceleration largely reflects a decline in electricity and gas prices. Still, the latest data showed inflation remains above the BOJ’s 2% price target. Consumer spending has held up so far as Japan emerges from the pandemic, but continued inflation could slow the recovery going forward.

What Bloomberg Economics Says...

“Looking ahead, a rise in electricity utility charges will push up the headline rate in June. That is likely to be countered by a bigger base effect from July that damps inflation. We see core inflation dropping below 2% in 4Q23.”

— Taro Kimura, economist

For the full report, click here

Electricity prices have continued to drag on overall inflation since government subsidies kicked in earlier this year. From May, households and businesses have also benefited from a reduction in levies that are used to support renewable energy development.

There’s still high uncertainty over the future of utility prices, as the government has granted requests from major power companies to raise residential electricity rates from June. This could motivate Kishida to extend existing relief measures set to expire in September, to preserve his reviving popularity until he calls a potentially early election.

Prices excluding energy and fresh food, a gauge of the underlying inflation trend, rose at the fastest pace since 1982, an indication that gains are still widespread outside the energy sector.

Cost-push inflation has been especially prominent in processed foods, which saw a 8.9% price rise from a year earlier.

(Updates with more details from the report)