Chinese chipmakers are speeding up investments in mature semiconductor equipment as the US and its allies tighten export controls on cutting-edge tech, according to Tokyo Electron Ltd.

Asia’s biggest semiconductor gear maker is seeing “extremely strong investment” in China and is winning new customers there, Tokyo Electron Chief Executive Officer Toshiki Kawai said on an earnings call Thursday. “This is not just a passing trend for this year,” he said. “We expect this demand to continue.”

That surge is helping to make up for investment delays by high-end logic chipmakers and foundries, the company said. China made up 39% of the company’s revenues in the June quarter.

Read more: US, Europe Growing Alarmed by China’s Rush Into Legacy Chips

Tokyo Electron is an important link in the chipmaking supply chain, providing the machinery that Taiwan Semiconductor Manufacturing Co., Samsung Electronics Co. and Intel Corp. rely on for their advanced silicon products. The Japanese company said it expects strong momentum in investments around automotive and industrial applications, a trend that’s continuing from the prior fiscal year.

Tokyo Electron stuck to its full-year revenue outlook of ¥1.7 trillion ($11.8 billion), despite sales dropping 17% in the June quarter in a global electronics slump. It earned an operating profit of ¥82.4 billion, just above estimates.

“Our Chinese clients are well aware of the restrictions and have reworked their strategies,” said Hiroshi Kawamoto, head of Tokyo Electron’s finance unit. The company’s seen no impact on operations or sales from Japan’s new curbs on shipments of chipmaking equipment, effective last month, he said.

The boost from China is helping Tokyo Electron as spending slows down elsewhere amid a market slump that’s stoking uncertainty in the global chip arena. In July, TSMC cut its annual sales outlook and postponed the start of production at its signature Arizona project to 2025.

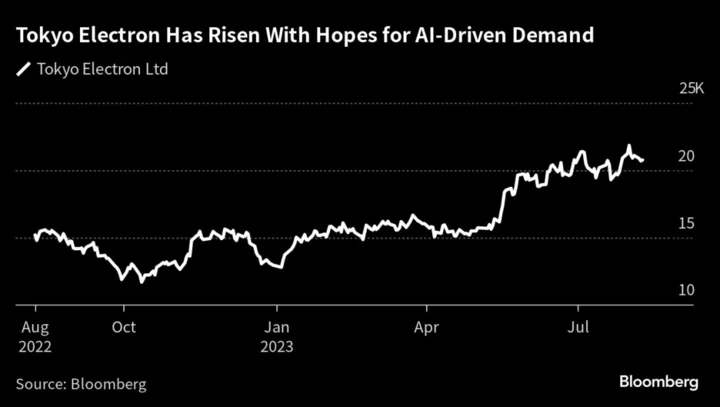

A surge in demand for AI-training chips — which made Nvidia Corp. the world’s first trillion-dollar chipmaker — is not translating to an immediate boost for chip gear makers.

“We are receiving many inquiries in artificial-intelligence-related investment,” said Kawamoto, adding that the company believes the overall chip market bottomed out last quarter. “The amount may at first be small,” but AI should start contributing to earnings next fiscal year, he said.

--With assistance from Mayumi Negishi.

(Updates with comments from executives)