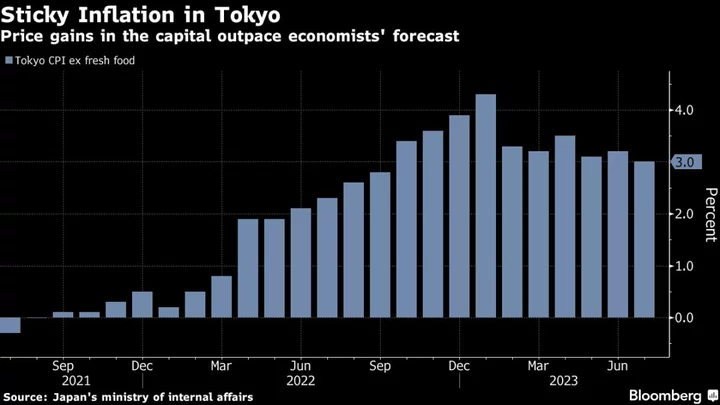

Inflation in Tokyo ran slightly hotter than economists were expecting in July, an outcome that casts some doubt on the Bank of Japan’s view that price growth will slow below its target in the coming months just as Governor Kazuo Ueda and his board meets to decide on policy.

Consumer prices excluding fresh food rose 3% in the capital, decelerating from last month’s 3.2% on the back of lower energy prices, the ministry of internal affairs said Friday. The advance beat analysts’ forecast of a 2.9% increase, underscoring the stickiness of underlying inflation.

The BOJ’s board will discuss whether to tweak yield curve control policy to let long-term interest rates rise above its 0.5% cap by “a certain degree,” the Nikkei reported, without attribution.

Tokyo data are a leading indicator for the national consumer price index, which is released around three weeks later.

Friday’s data suggest that cost-driven price growth still has some momentum, raising questions about the Ueda’s view that inflation will slow through the middle of this fiscal year. Since taking the helm at the BOJ in April, the governor has repeatedly expressed skepticism about the sustainability of recent price increases, pushing back against speculation of a near-term policy pivot.

The BOJ is set to announce its latest policy decision in a few hours, with a majority of market participants expecting no change in its accommodative setting. About 80% of surveyed economists expect the bank to maintain its high-profile yield curve control program, though some economists aren’t ruling out the possibility of adjustments.

What Bloomberg Economics Says...

“The numbers will likely signal that a peak has passed (although the BOJ this week will probably raise its forecast for average inflation this fiscal year to account for earlier elevated figures).”

— Taro Kimura, economist

For the full report, click here.

The central bank is also scheduled to release its updated price outlook report as soon as the meeting finishes. The bank’s latest forecasts will likely reflect the stronger-than-expected momentum already seen in price growth. The BOJ’s policy board will mull raising the consumer inflation forecast for the current fiscal year to around 2.5% from 1.8% in the April estimate, according to people familiar with the matter.

Meanwhile, the bank is likely to leave the price outlook for the following fiscal years largely unchanged due to a lack of confidence the bank can achieve its 2% inflation target in a stable manner.

(Updates with more details from the report)